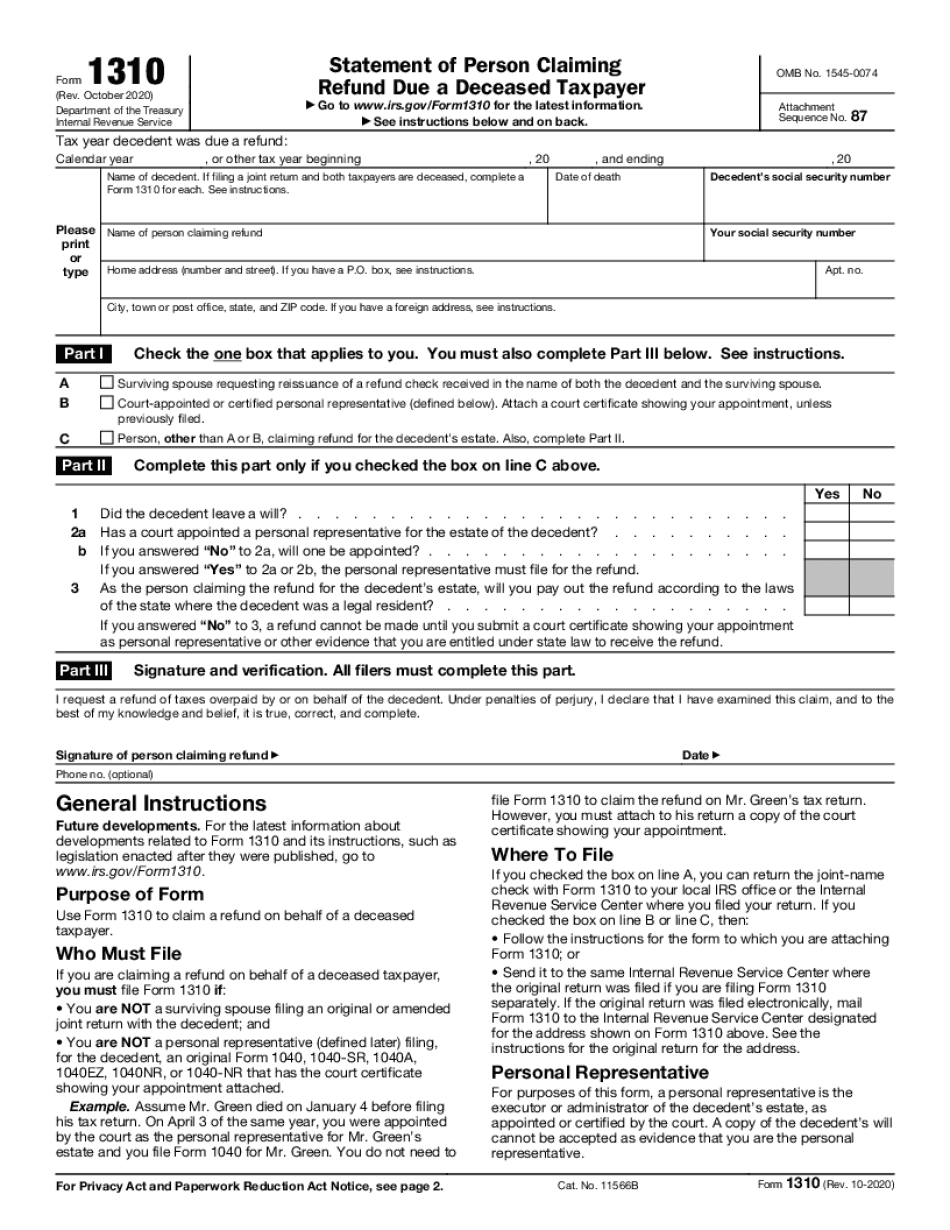

Irs Form 1310 For 2020

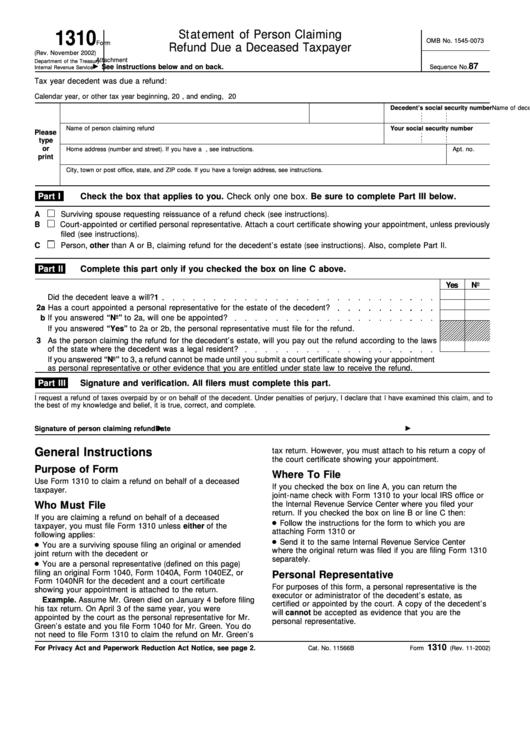

Irs Form 1310 For 2020 - Get ready for tax season deadlines by completing any required tax forms today. Web publication 17 (2021) pdf form 1040 (2020) us individual income tax return for tax year 2020. Complete, edit or print tax forms instantly. Individual income tax return, or form 843, claim for refund and request for abatement. Web a surviving spouse requesting reissuance of a refund check received in the name of both the decedent and the surviving spouse. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web editable irs 1310 2020. Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. Complete, sign, print and send your tax documents easily with us legal forms. Get form developments related to form 1310 and its instructions such as.

Ad access irs tax forms. Annual income tax return filed by citizens or residents of the. Generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Web if you filed a tax return with a spouse who died in 2020 and you want to change the name of the taxpayer on the refund check, you must file form 1310 statement of person claiming. Information about any future developments affecting form 1310 (such as legislation enacted after we. Individual income tax return, or form 843, claim for refund and request for abatement. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Web this information includes name, address, and the social security number of the person who is filing the tax return.

Web collect the right amount of tax. Get ready for tax season deadlines by completing any required tax forms today. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. Complete, edit or print tax forms instantly. Ad access irs tax forms. Complete, sign, print and send your tax documents easily with us legal forms. In today’s post, i’ll answer some common questions about requesting a tax refund. Information about any future developments affecting form 1310 (such as legislation enacted after we.

IRS 12256 20202021 Fill and Sign Printable Template Online US

If you are claiming a refund on behalf of a deceased taxpayer, you. Generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming. Then you have to provide all other required information in the. Web in order to claim a federal tax refund for a deceased person,.

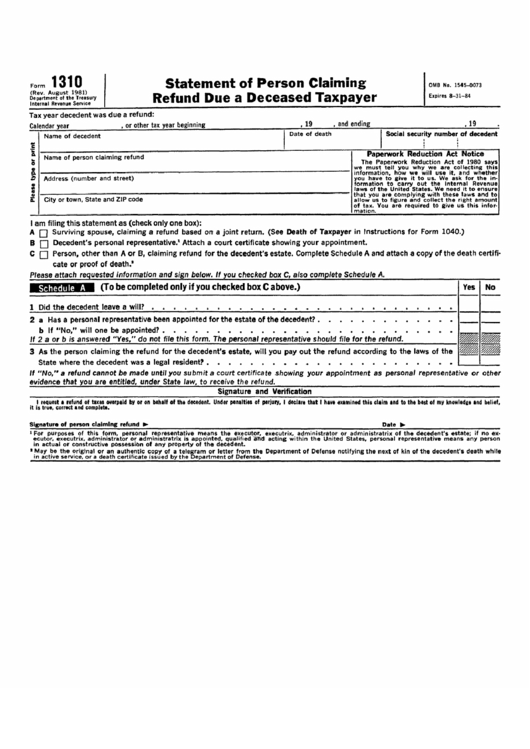

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Ad fill, sign, email irs 1310 & more fillable forms, try for free now! Complete, sign, print and send your tax documents easily with us legal forms. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Web publication 17 (2021).

IRS Publication 4038 20202021 Fill and Sign Printable Template

Generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming. If you are claiming a refund on behalf of a deceased taxpayer, you. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property.

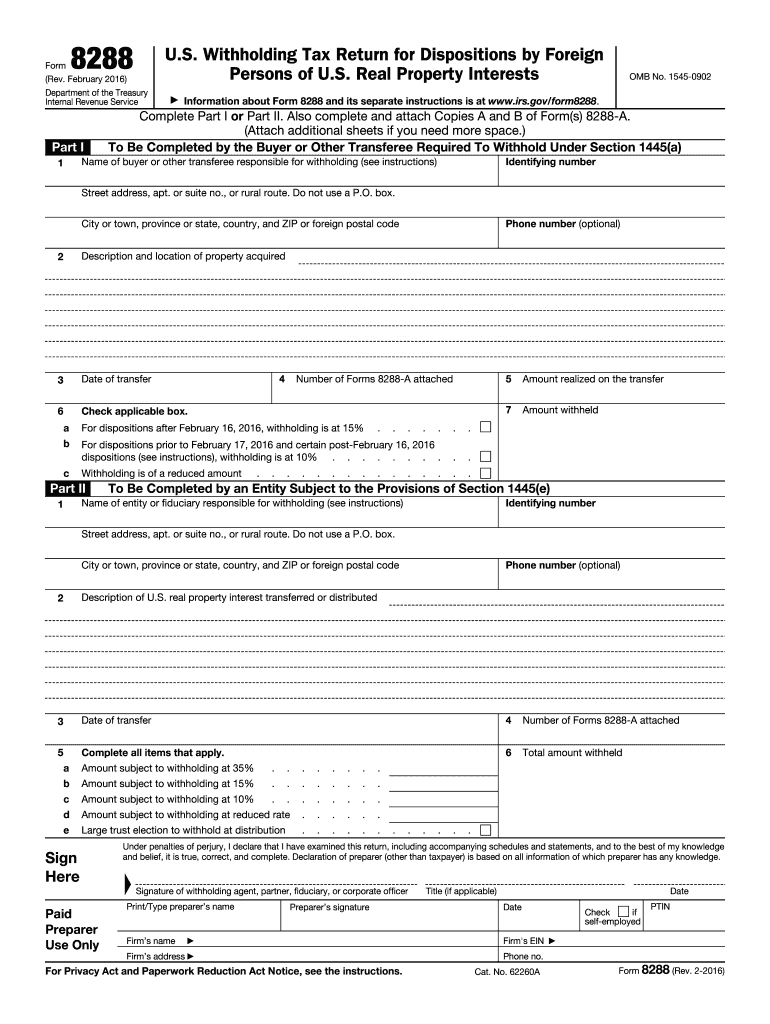

Irs Form 8288 Fill Out and Sign Printable PDF Template signNow

Get ready for tax season deadlines by completing any required tax forms today. Web developments related to form 1310 and its instructions, such as legislation enacted after they were published, go to. Complete, edit or print tax forms instantly. You must attach a copy of the court certificate. Generally, a person who is filing a return for a decedent and.

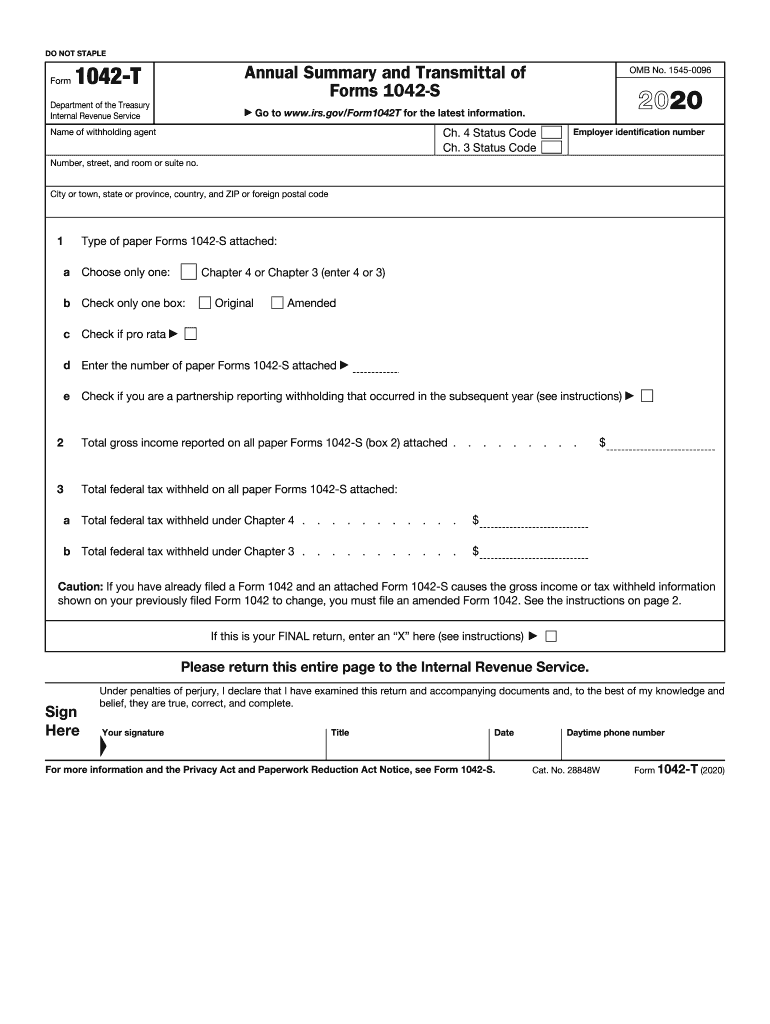

IRS 1042T 20202021 Fill and Sign Printable Template Online US

Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. Web collect the right amount of tax. Web developments related to form 1310 and its instructions, such as legislation enacted after they were published, go to. Then you.

Irs Form 1310 Printable Master of Documents

You must attach a copy of the court certificate. Web federal form 1310 instructions general instructions future developments. Complete, edit or print tax forms instantly. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web if you filed a.

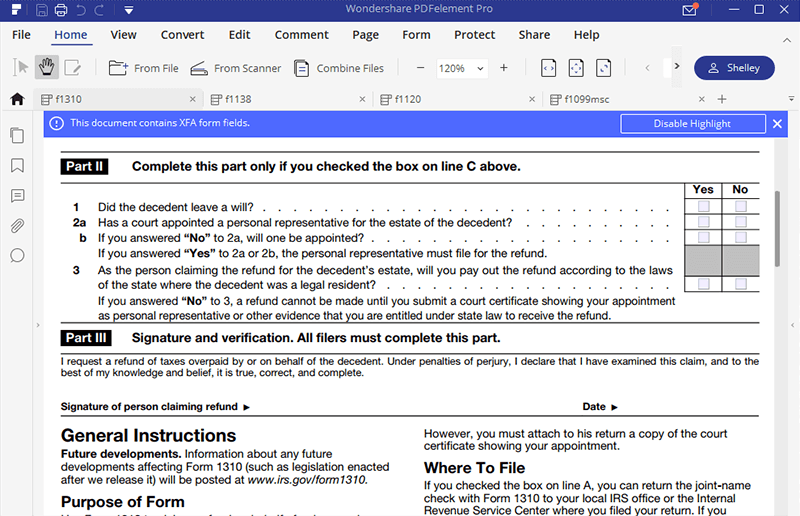

IRS Form 1310 How to Fill it Right

Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Download blank or fill out online in pdf format. Use form.

Irs Form 1310 Printable 2020 2021 Blank Sample to Fill out Online

Web this information includes name, address, and the social security number of the person who is filing the tax return. Web part i part ii part iii what is irs form 1310? Complete, sign, print and send your tax documents easily with us legal forms. Web collect the right amount of tax. Ad fill, sign, email irs 1310 & more.

IRS 990 Schedule H 2019 Fill and Sign Printable Template Online

Ad access irs tax forms. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Get ready for tax season deadlines by completing any required tax forms today. Web developments related to form 1310 and its instructions, such as legislation enacted.

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer

Annual income tax return filed by citizens or residents of the. Web a surviving spouse requesting reissuance of a refund check received in the name of both the decedent and the surviving spouse. Get ready for tax season deadlines by completing any required tax forms today. Information about any future developments affecting form 1310 (such as legislation enacted after we..

Use Form 1310 To Claim A Refund On Behalf Of A Deceased Taxpayer.

Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Individual income tax return, or form 843, claim for refund and request for abatement. Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Information about any future developments affecting form 1310 (such as legislation enacted after we.

Who Must File Irs Form 1310?

Download blank or fill out online in pdf format. In today’s post, i’ll answer some common questions about requesting a tax refund. Web use a irs form 1310 pdf 2020 template to make your document workflow more streamlined. Web editable irs 1310 2020.

Web If A Refund Is Due On The Individual Income Tax Return Of The Deceased, Claim The Refund By Submitting Form 1310, Statement Of A Person Claiming Refund Due A.

Generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Annual income tax return filed by citizens or residents of the. Get ready for tax season deadlines by completing any required tax forms today.

Web If You Filed A Tax Return With A Spouse Who Died In 2020 And You Want To Change The Name Of The Taxpayer On The Refund Check, You Must File Form 1310 Statement Of Person Claiming.

If you are claiming a refund on behalf of a deceased taxpayer, you. Ad access irs tax forms. Complete, edit or print tax forms instantly. Get form developments related to form 1310 and its instructions such as.