Oklahoma Form 511-A

Oklahoma Form 511-A - Government obligations interest on us. Oklahoma resident income tax return • form 511: Agency code '695' form title: Web below is a list of income that needs to be added to your oklahoma return. Web oklahoma standard deduction or federal itemized deductions. Exemptions ($1,000 x total number of exemptions claimed above). Ad download or email ok form 511 & more fillable forms, register and subscribe now! Web state of oklahoma other credits form provide this form and supporting documents with your oklahoma tax return. Web resident taxpayer who receives income for personal services performed in another state must report the full amount of such income on the oklahoma return (form 511). State and municipal bond interest.

If the internal revenue code (irc) of. Ad download or email ok form 511 & more fillable forms, register and subscribe now! Web 1 single 2married filing joint return (even if only one had income) 3married filing separate • if spouse is name:also filing, list name and ssn in the boxes: • instructions for completing the form 511: Oklahoma resident income tax return : You will not be able to upload. 2011 oklahoma resident individual income tax forms: Agency code '695' form title: Government obligations interest on us. Name as shown on return:

Oklahoma resident income tax return : If the internal revenue code (irc) of. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web resident taxpayer who receives income for personal services performed in another state must report the full amount of such income on the oklahoma return (form 511). When to file an amended return generally, to claim a. Web state of oklahoma other credits form provide this form and supporting documents with your oklahoma tax return. Government obligations interest on us. Web the oklahoma eic is refundable beginning with tax year 2022. • instructions for completing the form 511: Web below is a list of income that needs to be added to your oklahoma return.

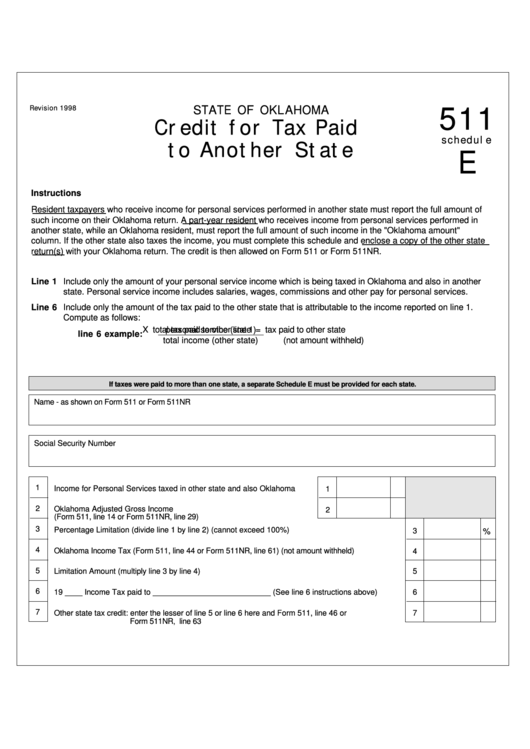

Fillable Form 511 Schedule E Credit For Tax Paid To Another State

Oklahoma resident income tax return : Oklahoma resident income tax return • form 511: If the internal revenue code (irc) of. State and municipal bond interest. Web 1 single 2married filing joint return (even if only one had income) 3married filing separate • if spouse is name:also filing, list name and ssn in the boxes:

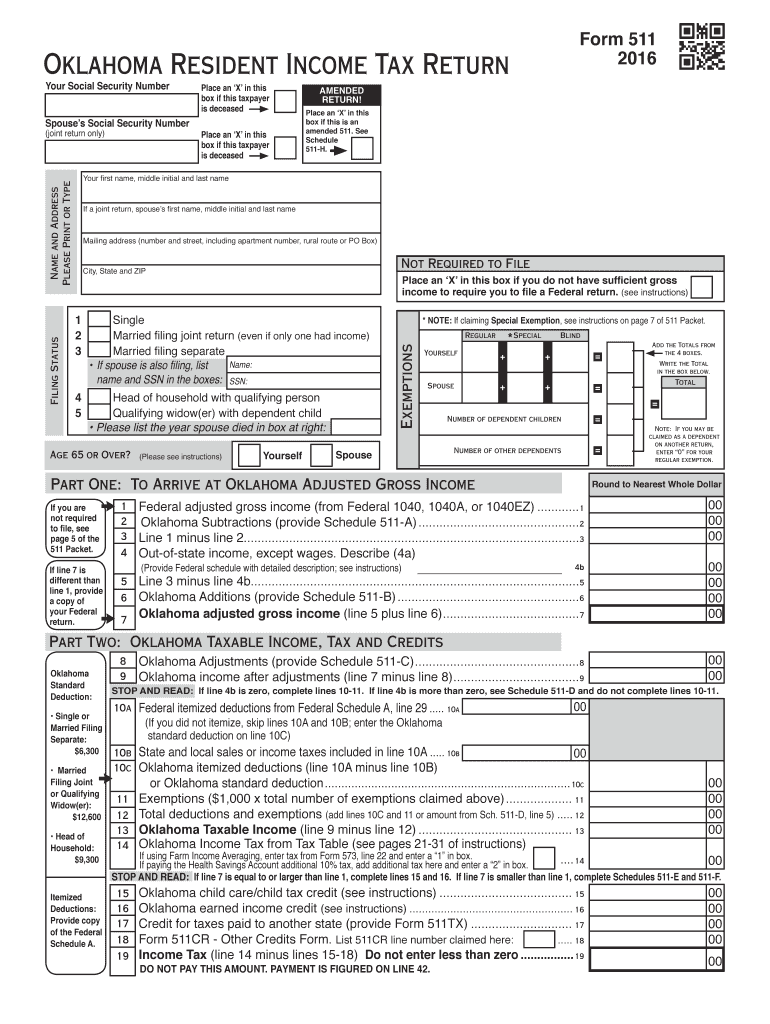

Form 511 Oklahoma Resident Tax Return and Sales Tax Relief

Web instructions for form 511x this form is for residents only. • instructions for completing the form 511: Oklahoma resident income tax return • form 511: Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Web the oklahoma eic is refundable beginning with tax year 2022.

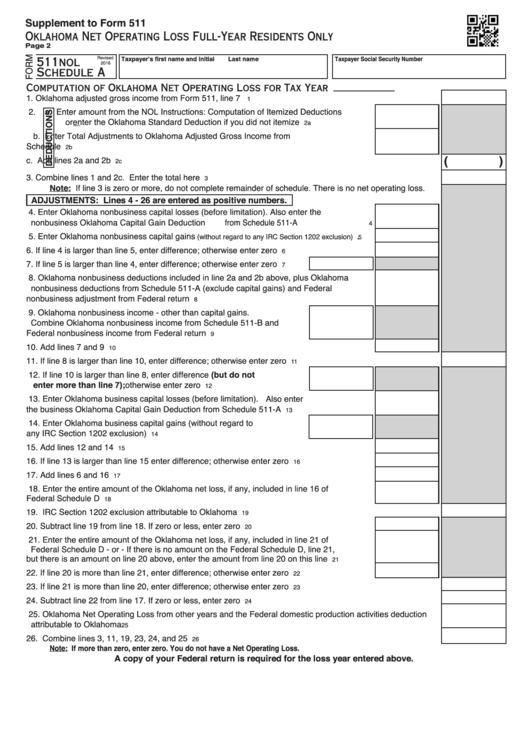

Fillable Form 511Nol Oklahoma Net Operating Loss FullYear Residents

Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Oklahoma resident income tax return • form 511: Ad download or email ok form 511 & more fillable forms, register and subscribe now! When to file an amended return generally, to claim a. Oklahoma resident income tax return form • form.

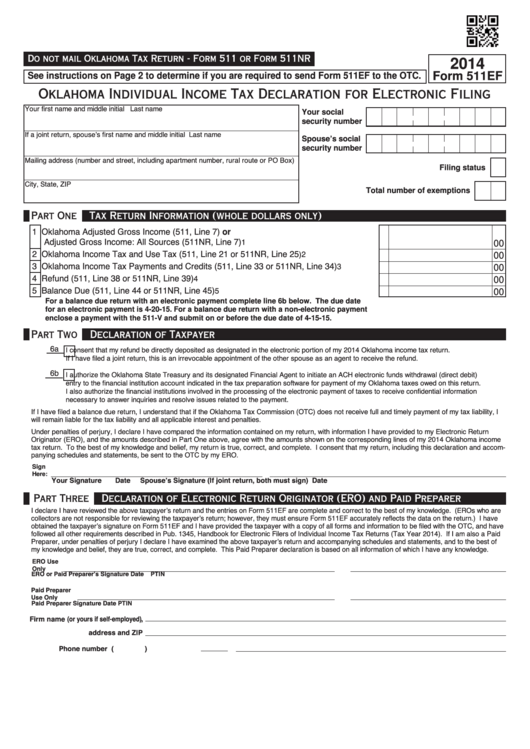

Oklahoma form 2014 Fill out & sign online

Web resident taxpayer who receives income for personal services performed in another state must report the full amount of such income on the oklahoma return (form 511). Web oklahoma standard deduction or federal itemized deductions. • instructions for completing the form 511: Web 1 single 2married filing joint return (even if only one had income) 3married filing separate • if.

Fillable Form 511ef Oklahoma Individual Tax Declaration For

Web 1 single 2married filing joint return (even if only one had income) 3married filing separate • if spouse is name:also filing, list name and ssn in the boxes: If the internal revenue code (irc) of. Name as shown on return: Government obligations interest on us. Complete, edit or print tax forms instantly.

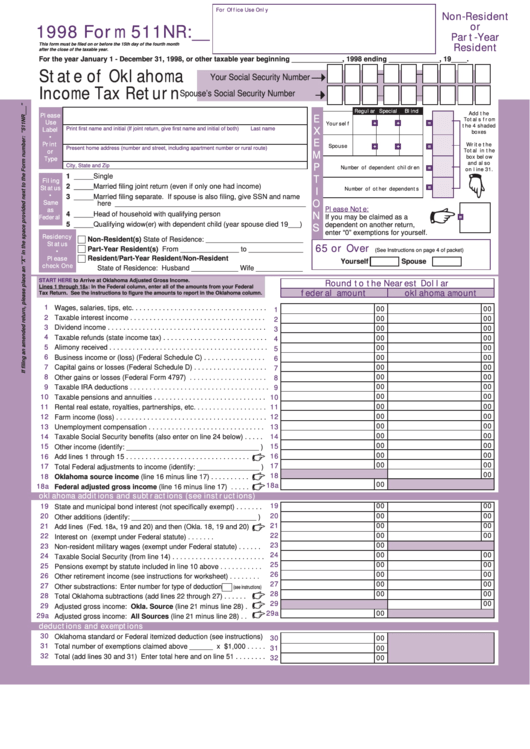

Fillable Form 511nr State Of Oklahoma Tax Return 1998

Government obligations interest on us. Oklahoma resident income tax return form • form. State and municipal bond interest. 2011 oklahoma resident individual income tax forms: Name as shown on return:

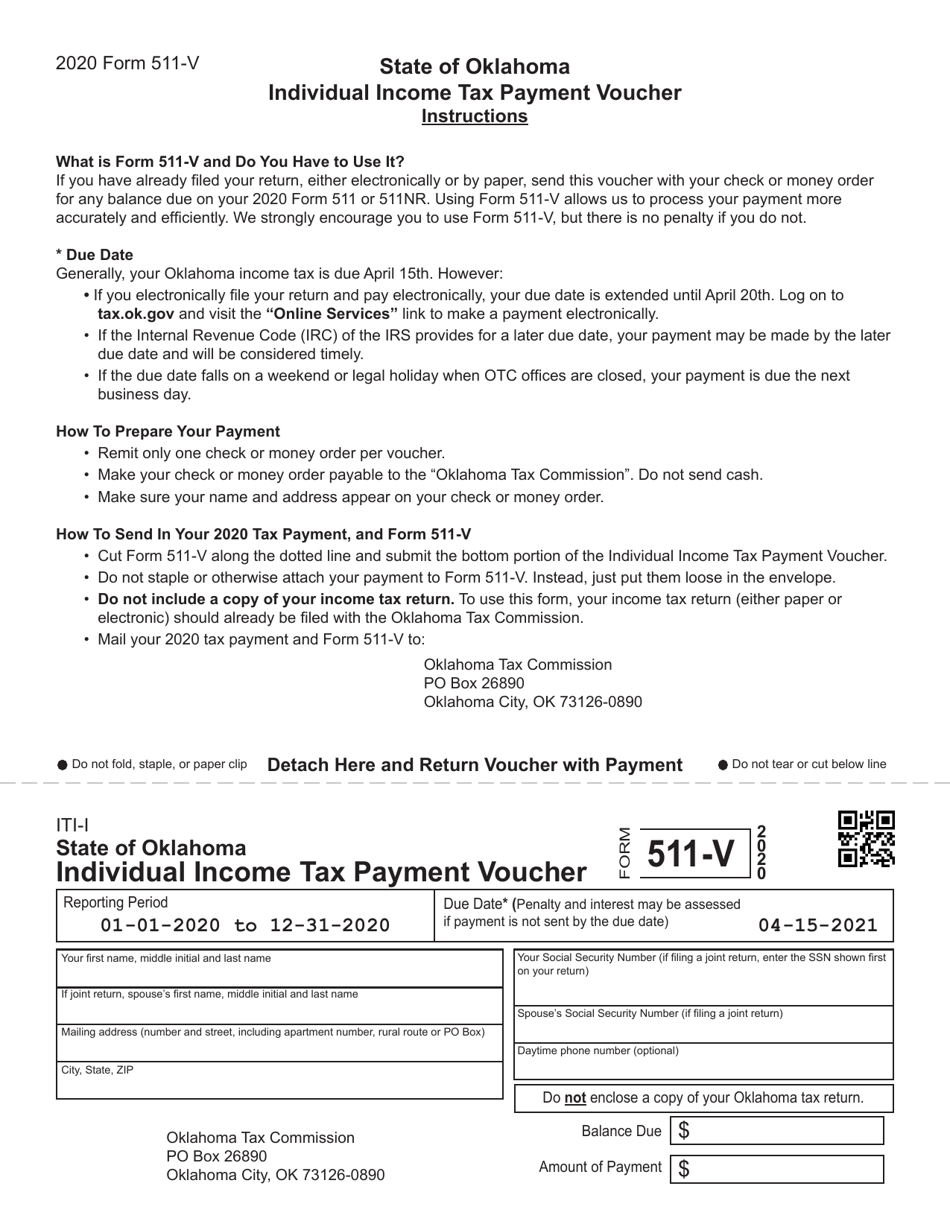

Form 511V Download Fillable PDF or Fill Online Individual Tax

Name as shown on return: • instructions for completing the form 511: This form is for income earned in tax year 2022, with tax returns due in april 2023. Government obligations interest on us. Web instructions for form 511x this form is for residents only.

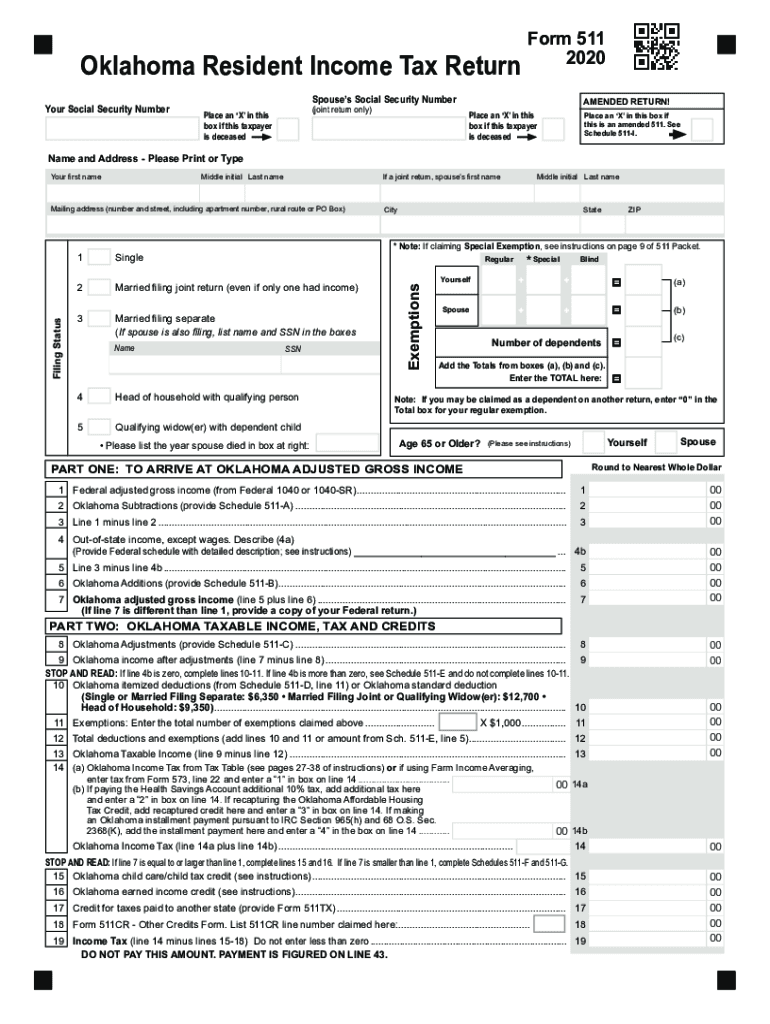

2020 Form OK 511 & 538S Fill Online, Printable, Fillable, Blank

Oklahoma resident income tax return form • form. Government obligations interest on us. Web and is deducted in the “oklahoma amount column.” note: 2011 oklahoma resident individual income tax forms: This form is for income earned in tax year 2022, with tax returns due in april 2023.

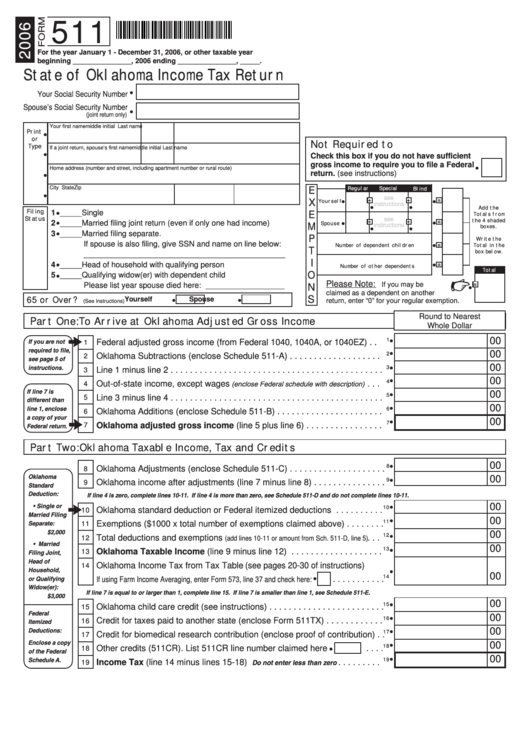

Form 511 State Of Oklahoma Tax Return 2006 printable pdf

2011 oklahoma resident individual income tax forms: Web the oklahoma eic is refundable beginning with tax year 2022. If the internal revenue code (irc) of. Web resident taxpayer who receives income for personal services performed in another state must report the full amount of such income on the oklahoma return (form 511). Web state of oklahoma other credits form provide.

Form 511NR Oklahoma Nonresident Part Year Tax Return YouTube

Oklahoma resident income tax return : Many adjustments required supporting documentation to be attached with your adjustment claim. When to file an amended return generally, to claim a. Web the oklahoma eic is refundable beginning with tax year 2022. Complete, edit or print tax forms instantly.

Government Obligations Interest On Us.

Many adjustments required supporting documentation to be attached with your adjustment claim. Web and is deducted in the “oklahoma amount column.” note: Web instructions for form 511x this form is for residents only. Web below is a list of income that needs to be added to your oklahoma return.

Web Oklahoma Standard Deduction Or Federal Itemized Deductions.

Web state of oklahoma other credits form provide this form and supporting documents with your oklahoma tax return. Exemptions ($1,000 x total number of exemptions claimed above). • instructions for completing the form 511: Oklahoma resident income tax return form • form.

State And Municipal Bond Interest.

Web resident taxpayer who receives income for personal services performed in another state must report the full amount of such income on the oklahoma return (form 511). Oklahoma resident income tax return : Agency code '695' form title: Web 1 single 2married filing joint return (even if only one had income) 3married filing separate • if spouse is name:also filing, list name and ssn in the boxes:

Ad Download Or Email Ok Form 511 & More Fillable Forms, Register And Subscribe Now!

Oklahoma resident income tax return • form 511: Oklahoma resident income tax return form • form. Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Ad download or email ok form 511 & more fillable forms, register and subscribe now!