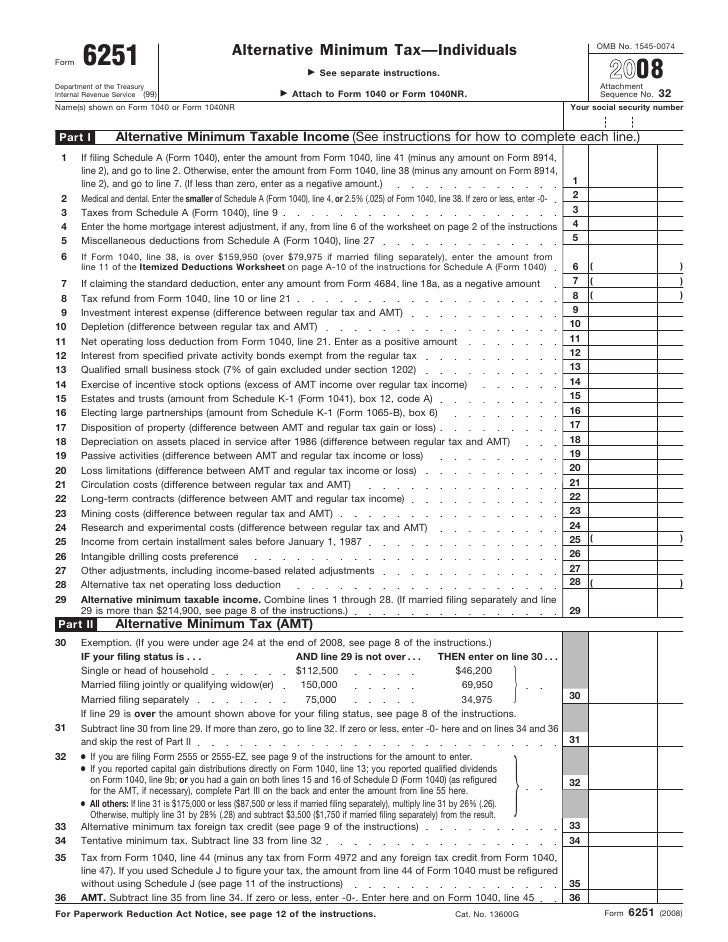

Tax Form 6251

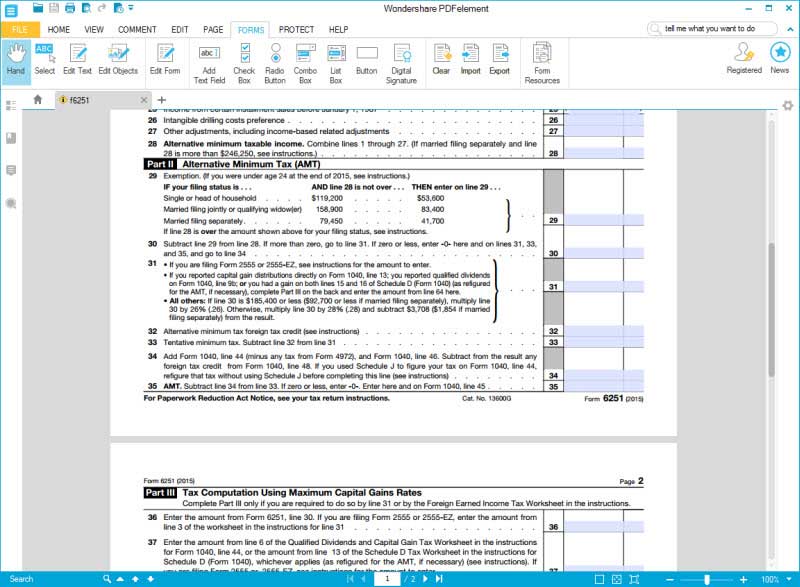

Tax Form 6251 - Alternative minimum tax shows that your tentative minimum tax is less than your regular tax, you don't owe any amt, but you may still be affected by the amt in other ways. The amt applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. You figure a negative adjustment of $65,000 for the difference between the $65,000 of regular tax ordinary income and the $0 of amt ordinary income for the first sale. Web form 6251 2022 alternative minimum tax—individuals department of the treasury internal revenue service go to www.irs.gov/form6251 for instructions and the latest information. Web what happens to my tax credits? 1= force form 6251, 2= when applicable. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount of income, but are able to eliminate most, if not all, income from taxation using deductions and credits. The program calculates and prints form 6251, if it applies to the taxpayer's return. In order for wealthy individuals to pay their fair share of income tax, congress mandated an in 1969.

If the calculation on form 6251: Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Alternative minimum tax shows that your tentative minimum tax is less than your regular tax, you don't owe any amt, but you may still be affected by the amt in other ways. The program calculates and prints form 6251, if it applies to the taxpayer's return. Web you enter a total negative adjustment of $118,000 on line 2k of your 2022 form 6251, figured as follows. Web what happens to my tax credits? The amt applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. Web form 6251 alternative minimum tax. You have to pay the alternative minimum tax if you report taxable income greater than certain income. The amt is a separate tax that is imposed in addition to your regular tax.

Web irs form 6251, titled alternative minimum tax—individuals, determines how much alternative minimum tax (amt) you could owe. 1= force form 6251, 2= when applicable. The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount of income, but are able to eliminate most, if not all, income from taxation using deductions and credits. It applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. Web you enter a total negative adjustment of $118,000 on line 2k of your 2022 form 6251, figured as follows. Web form 6251 alternative minimum tax. If the calculation on form 6251: You have to pay the alternative minimum tax if you report taxable income greater than certain income. Alternative minimum tax shows that your tentative minimum tax is less than your regular tax, you don't owe any amt, but you may still be affected by the amt in other ways. In order for wealthy individuals to pay their fair share of income tax, congress mandated an in 1969.

irs 2019 tax form 6251 Fill Online, Printable, Fillable Blank form

Web form 6251, “alternative minimum tax—individuals,” is a tax form that calculates whether you’re liable for paying the alternative minimum tax and if so, how much you should pay. You have to pay the alternative minimum tax if you report taxable income greater than certain income. The program calculates and prints form 6251, if it applies to the taxpayer's return..

Form 6251Alternative Minimum Tax

It applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. Web form 6251 alternative minimum tax. Web what happens to my tax credits? The program calculates and prints form 6251, if it applies to the taxpayer's return. Web you enter a total negative adjustment of $118,000.

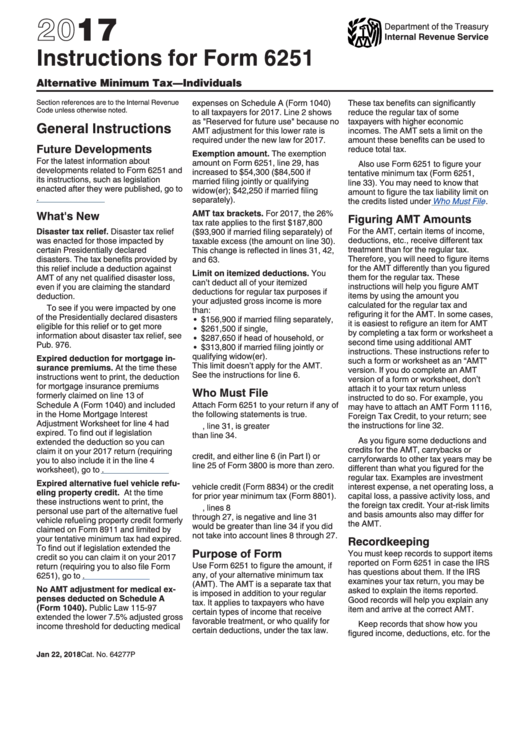

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2017

Although reducing your taxable income to zero is perfectly legal, the irs uses amt to insure everyone pays their fair share. Web form 6251, “alternative minimum tax—individuals,” is a tax form that calculates whether you’re liable for paying the alternative minimum tax and if so, how much you should pay. Web form 6251 alternative minimum tax. Web form 6251 2022.

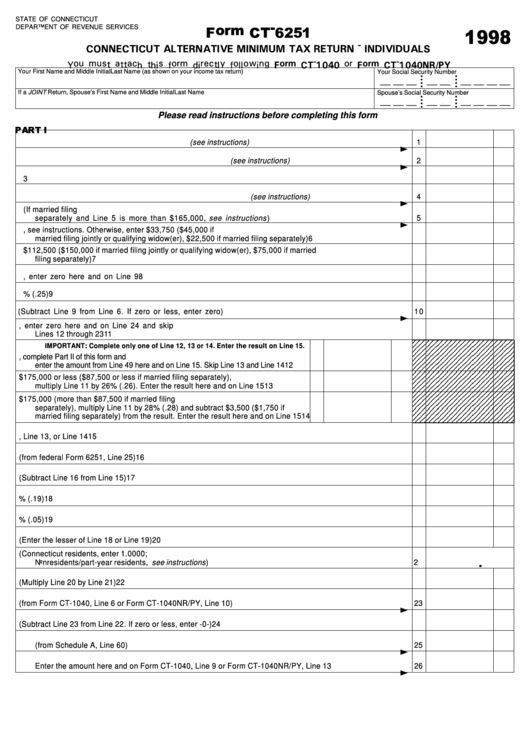

Fillable Form Ct6251 Connecticut Alternative Minimum Tax Return For

It applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. The program calculates and prints form 6251, if it applies to the taxpayer's return. Web form 6251, “alternative minimum tax—individuals,” is a tax form that calculates whether you’re liable for paying the alternative minimum tax and.

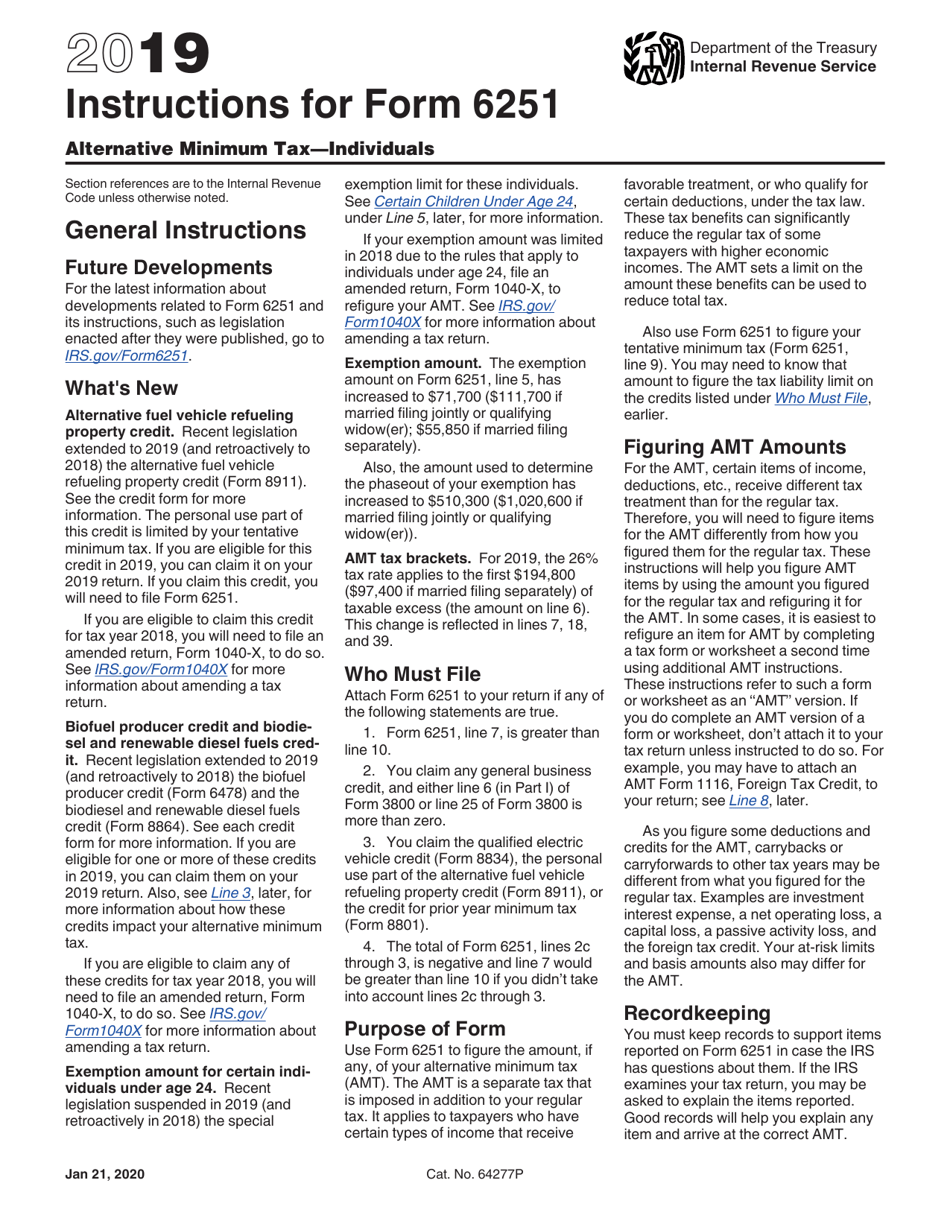

Download Instructions for IRS Form 6251 Alternative Minimum Tax

In order for wealthy individuals to pay their fair share of income tax, congress mandated an in 1969. It applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. Web irs form 6251, titled alternative minimum tax—individuals, determines how much alternative minimum tax (amt) you could owe..

Instructions for How to Fill in IRS Form 6251

You have to pay the alternative minimum tax if you report taxable income greater than certain income. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). 1= force form 6251, 2= when applicable. Web what happens to my tax.

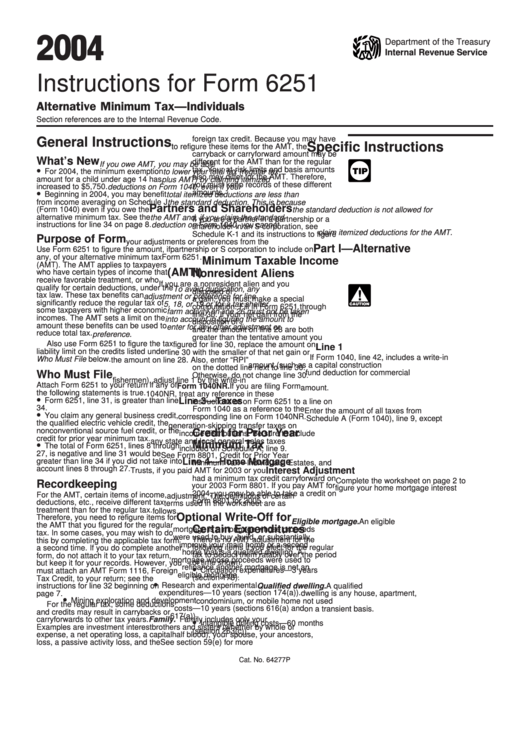

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2004

You figure a negative adjustment of $65,000 for the difference between the $65,000 of regular tax ordinary income and the $0 of amt ordinary income for the first sale. The amt applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. The amt is a separate tax.

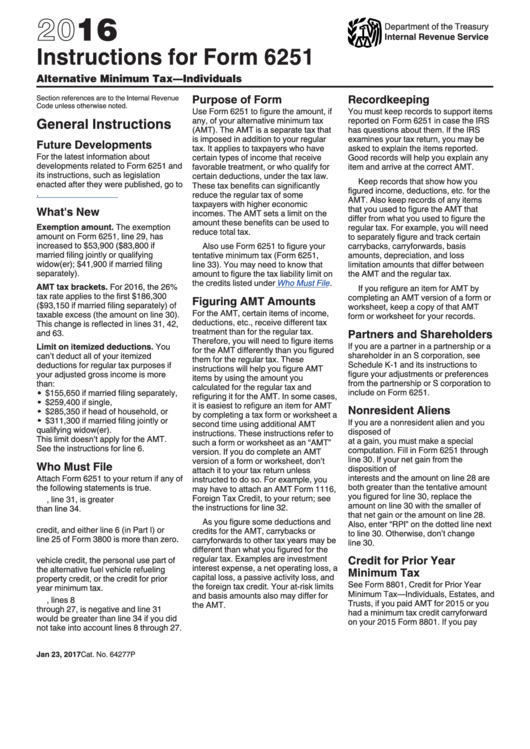

Instructions For Form 6251 2016 printable pdf download

The program calculates and prints form 6251, if it applies to the taxpayer's return. Web what happens to my tax credits? Alternative minimum tax shows that your tentative minimum tax is less than your regular tax, you don't owe any amt, but you may still be affected by the amt in other ways. You have to pay the alternative minimum.

Instructions for IRS Form 6251 Alternative Minimum Taxindividuals

Alternative minimum tax shows that your tentative minimum tax is less than your regular tax, you don't owe any amt, but you may still be affected by the amt in other ways. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). The amt is a separate tax that is imposed in addition to your.

Form 6251 Alternative Minimum Tax Individuals (2014) Free Download

The program calculates and prints form 6251, if it applies to the taxpayer's return. Web form 6251 2022 alternative minimum tax—individuals department of the treasury internal revenue service go to www.irs.gov/form6251 for instructions and the latest information. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Use form 6251 to figure the amount, if.

You Figure A Negative Adjustment Of $65,000 For The Difference Between The $65,000 Of Regular Tax Ordinary Income And The $0 Of Amt Ordinary Income For The First Sale.

Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). The program calculates and prints form 6251, if it applies to the taxpayer's return. Alternative minimum tax shows that your tentative minimum tax is less than your regular tax, you don't owe any amt, but you may still be affected by the amt in other ways. Web you enter a total negative adjustment of $118,000 on line 2k of your 2022 form 6251, figured as follows.

The Amt Applies To Taxpayers Who Have Certain Types Of Income That Receive Favorable Treatment, Or Who Qualify For Certain Deductions, Under The Tax Law.

Web what happens to my tax credits? If the calculation on form 6251: Web irs form 6251, titled alternative minimum tax—individuals, determines how much alternative minimum tax (amt) you could owe. The amt is a separate tax that is imposed in addition to your regular tax.

The Irs Imposes The Alternative Minimum Tax (Amt) On Certain Taxpayers Who Earn A Significant Amount Of Income, But Are Able To Eliminate Most, If Not All, Income From Taxation Using Deductions And Credits.

Web form 6251 2022 alternative minimum tax—individuals department of the treasury internal revenue service go to www.irs.gov/form6251 for instructions and the latest information. You have to pay the alternative minimum tax if you report taxable income greater than certain income. Web form 6251 alternative minimum tax. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt).

It Applies To Taxpayers Who Have Certain Types Of Income That Receive Favorable Treatment, Or Who Qualify For Certain Deductions, Under The Tax Law.

Web form 6251, “alternative minimum tax—individuals,” is a tax form that calculates whether you’re liable for paying the alternative minimum tax and if so, how much you should pay. Although reducing your taxable income to zero is perfectly legal, the irs uses amt to insure everyone pays their fair share. It adds back various tax breaks you might have claimed on your form 1040 tax return, then determines your taxes owed. In order for wealthy individuals to pay their fair share of income tax, congress mandated an in 1969.