What Is Form 8867

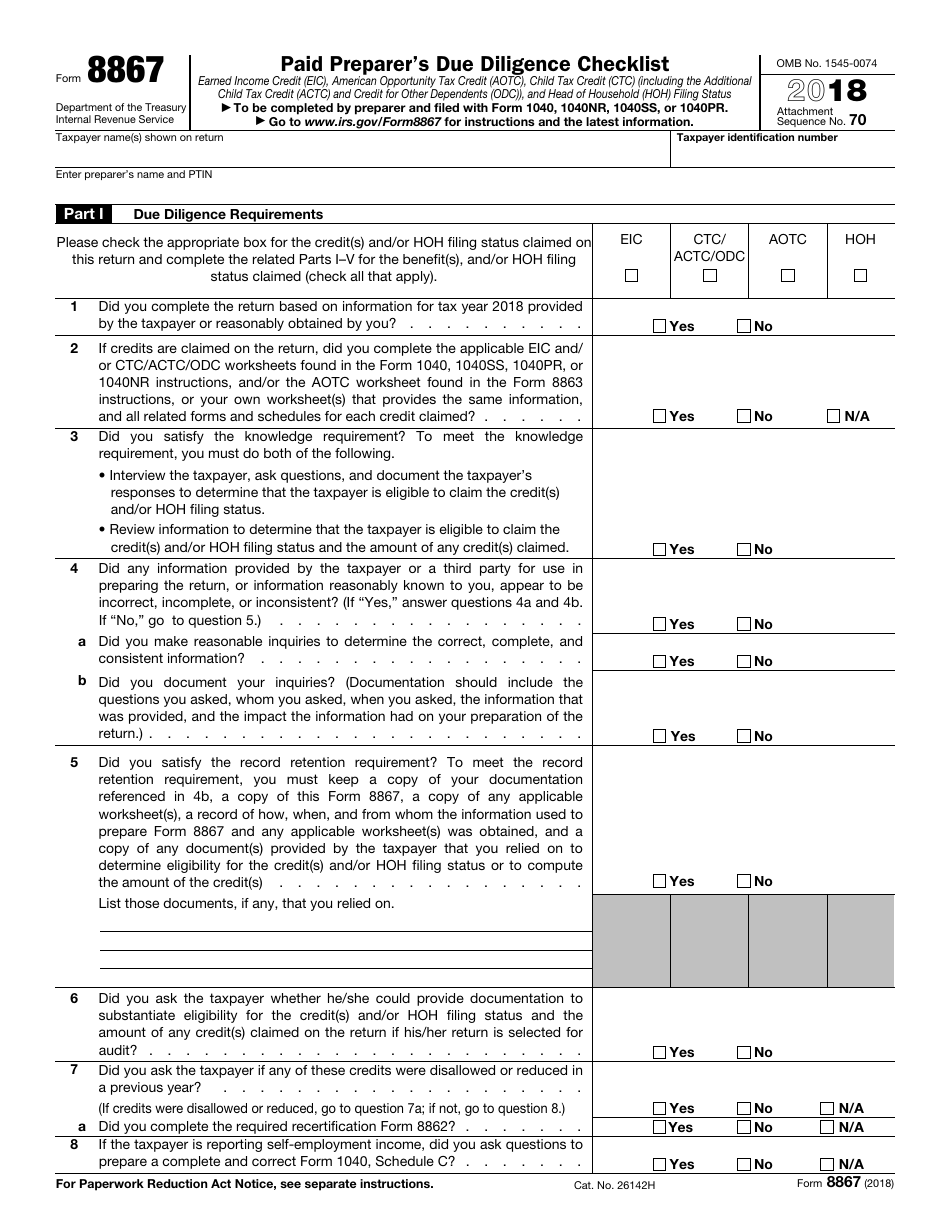

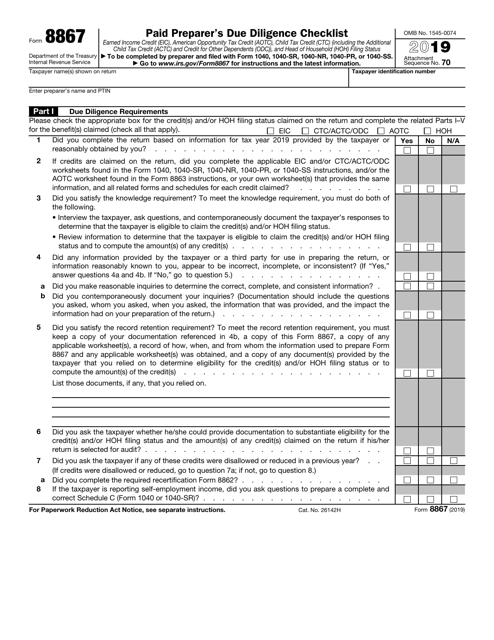

What Is Form 8867 - November 2022) paid preparer’s due diligence checklist for the earned income credit,. Web form 8867 must be filed with the return. Earned income credit (eic), american. So what is new is that form 8867, which is the paid preparer's due diligence checklist, now has a. Web what is form 8867? Web what is form 8867? Web what is form 8867? Web the purpose of form 8867 is to ensure that the tax preparer has considered all applicable eic eligibility requirements for each prepared tax return. Form 8867 must be filed with the taxpayer’s return or amended return claiming the eic, the ctc/actc/odc, the aotc, and/or hoh filing. Web what is form 8867?

Web what is form 8867? Try it for free now! Web keep a copy of the completed form 8867. December 2021) department of the treasury internal revenue service. Form 8867 must be filed with the taxpayer’s return or amended return claiming the eic, the ctc/actc/odc, the aotc, and/or hoh filing. Get ready for tax season deadlines by completing any required tax forms today. Web form 8867 must be filed with the return. However, checking off boxes is not enough to satisfy the due diligence requirements. Web what is form 8867? Web what is form 8867?

Web form 8867 must be filed with the return. Try it for free now! Web complete this form 8867 truthfully and accurately and complete the actions described in this checklist for any applicable credit(s) claimed and hoh filing status, if claimed;. Ad upload, modify or create forms. Publication 4687 pdf, paid preparer due. Web keep a copy of the completed form 8867. December 2021) department of the treasury internal revenue service. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web what is form 8867? Web form 8867 must be submitted with the taxpayer’s return.

Form 8867 amulette

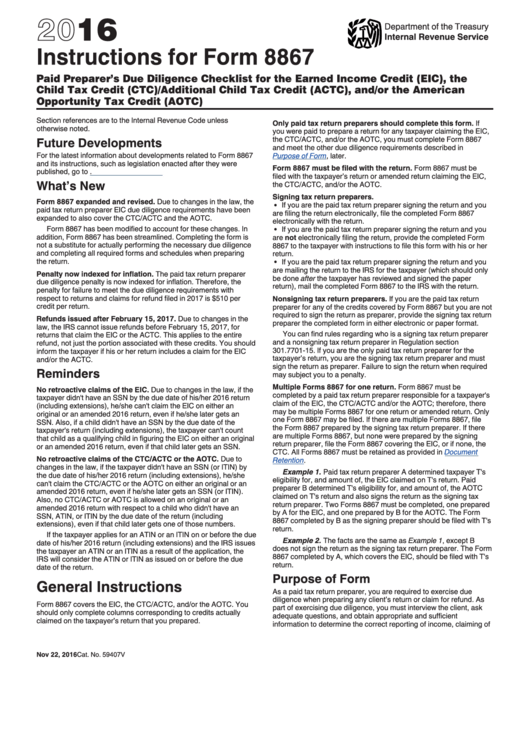

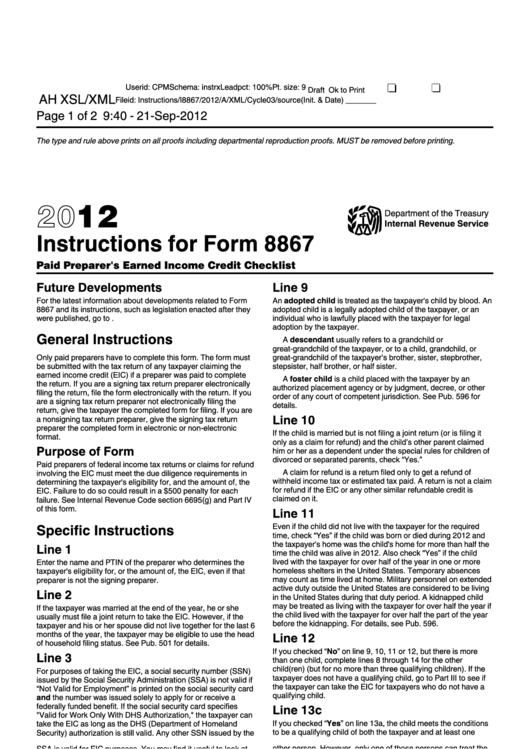

December 2021) department of the treasury internal revenue service. Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc. Download or email irs 8867 & more fillable forms, register and subscribe now! Web instructions for form 8867 department of the treasury internal revenue service (rev..

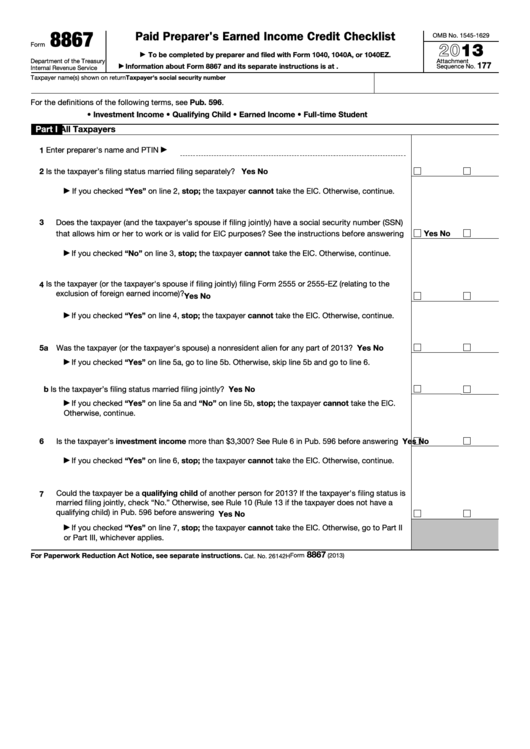

Fillable Form 8867 Paid Preparer'S Earned Credit Checklist

Earned income credit (eic), american. Try it for free now! Download or email irs 8867 & more fillable forms, register and subscribe now! As part of exercising due. Web complete form 8867 truthfully and accurately and complete the actions described on form 8867 for each credit claimed for which a person is the paid tax return preparer.

Instructions For Form 8867 Paid Preparer'S Due Diligence Checklist

Ad upload, modify or create forms. Web complete this form 8867 truthfully and accurately and complete the actions described in this checklist for any applicable credit(s) claimed and hoh filing status, if claimed;. Web the due diligence requirement on form 8867, paid preparer’s due accuracy checklist, by the child tax credit may apply to 2022 tax returns claiming qualifying children.

Form 8867 Paid Preparer's Earned Credit Checklist (2014) Free

Web what is form 8867? Due diligence on the go! Earned income credit (eic), american. Publication 4687 pdf, paid preparer due. Paid preparer’s due diligence checklist.

IRS Form 8867 Download Fillable PDF or Fill Online Paid Preparer's Due

Individual income tax return,” is a form that taxpayers can file with the irs if. Web complete this form 8867 truthfully and accurately and complete the actions described in this checklist for any applicable credit(s) claimed and hoh filing status, if claimed;. Publication 4687 pdf, paid preparer due. Web form 4868, also known as an “application for automatic extension of.

Form 8867 Paid Preparer`s Due Diligence Checklist Editorial Stock Photo

Web what is form 8867? Web the due diligence requirement on form 8867, paid preparer’s due accuracy checklist, by the child tax credit may apply to 2022 tax returns claiming qualifying children for the child. Publication 4687 pdf, paid preparer due. Web due diligence required under the final regulations promulgated under section 6695 on november 5, 2018, completing form 8867.

2020 Form IRS 8867 Fill Online, Printable, Fillable, Blank pdfFiller

Ad upload, modify or create forms. Web the due diligence requirement on form 8867, paid preparer’s due accuracy checklist, by the child tax credit may apply to 2022 tax returns claiming qualifying children for the child. Web what is form 8867? Web complete this form 8867 truthfully and accurately and complete the actions described in this checklist for any applicable.

Form 8867 Paid Preparer's Earned Credit Checklist (2014) Free

Try it for free now! Web what is form 8867? Web what is form 8867? Download or email irs 8867 & more fillable forms, register and subscribe now! Individual income tax return,” is a form that taxpayers can file with the irs if.

IRS Form 8867 Download Fillable PDF or Fill Online Paid Preparer's Due

Web instructions for form 8867 department of the treasury internal revenue service (rev. Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc. As part of exercising due. Web the due diligence requirement on form 8867, paid preparer’s due accuracy checklist, by the child tax.

Web Form 8867, Paid Preparer’s Due Diligence Checklist, Must Be Filed With The Tax Return For Any Taxpayer Claiming Eic, The Ctc/Actc, And/Or The Aotc.

Publication 4687 pdf, paid preparer due. Web what is form 8867? Web what is form 8867? Web what is form 8867?

Web The Due Diligence Requirement On Form 8867, Paid Preparer’s Due Accuracy Checklist, By The Child Tax Credit May Apply To 2022 Tax Returns Claiming Qualifying Children For The Child.

Web as a tax preparer your due diligence requirements were expanded by tcja. Due diligence on the go! Web complete form 8867 truthfully and accurately and complete the actions described on form 8867 for each credit claimed for which a person is the paid tax return preparer. Web form 4868, also known as an “application for automatic extension of time to file u.s.

Web Instructions For Form 8867 Department Of The Treasury Internal Revenue Service (Rev.

Ad upload, modify or create forms. Web keep a copy of the completed form 8867. Download or email irs 8867 & more fillable forms, register and subscribe now! Paid preparer’s due diligence checklist.

Try It For Free Now!

Due diligence on the go! Web complete this form 8867 truthfully and accurately and complete the actions described in this checklist for any applicable credit(s) claimed and hoh filing status, if claimed;. The preparer can inquire about possible documents the client may have or can get to support claiming the children for. November 2022) paid preparer’s due diligence checklist for the earned income credit,.