Where To File Form 3520

Where To File Form 3520 - The form provides information about the foreign trust, its u.s. Web as the title suggests, form 3520 is used by u.s. If the answer is “yes,” then you need to file. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Ad talk to our skilled attorneys by scheduling a free consultation today. Persons to report (1) certain transactions that have occurred with respect to foreign trusts and (2) the receipt of gifts from foreign. Web form 3115 mailing addresses. Web form 3520 & instructions: The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to.

Ad talk to our skilled attorneys by scheduling a free consultation today. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. It does not have to be a “foreign gift.” rather, if a. If the answer is “yes,” then you need to file. If you own any part of a foreign trust, you will probably have to file this form. Person receives a gift, inheritance (a type of “gift”) from a foreign person, or a foreign trust distribution. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Send form 3520 to the. Web form 3115 mailing addresses. The form provides information about the foreign trust, its u.s.

Web form 3520 is an information return for a u.s. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. Send form 3520 to the. Web form 3115 mailing addresses. Owners of a foreign trust. Owner, is march 15, and the due date for. If you own any part of a foreign trust, you will probably have to file this form. Web form 3520 for u.s. If the answer is “yes,” then you need to file.

Do I need to file IRS Form 3520 and 3520A for my TFSA and RESP?

Web as the title suggests, form 3520 is used by u.s. Ad talk to our skilled attorneys by scheduling a free consultation today. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. If the answer is “yes,” then you need to.

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Owner, is march 15, and the due date for. Web form 3520 is an information return for a u.s. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Send form 3520 to the.

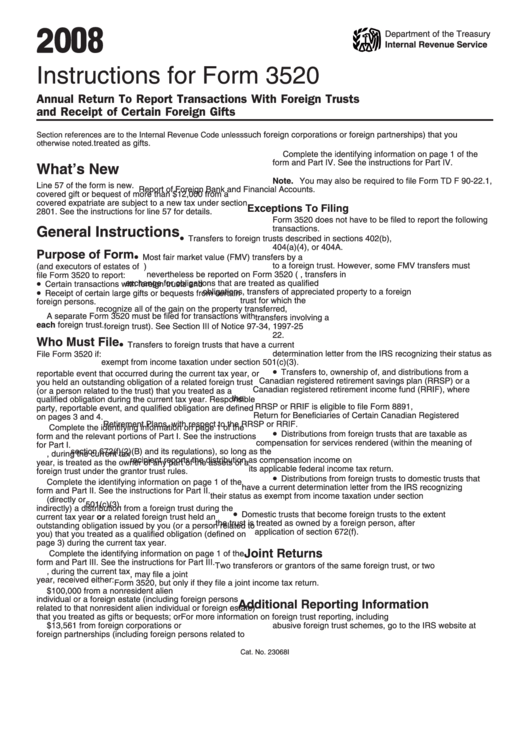

Form 3520 Annual Return to Report Transactions with Foreign Trusts

It does not have to be a “foreign gift.” rather, if a. Web form 3520 is an information return for a u.s. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Send form 3520 to the.

Instructions For Form 3520 Annual Return To Report Transactions With

The form provides information about the foreign trust, its u.s. Persons to report (1) certain transactions that have occurred with respect to foreign trusts and (2) the receipt of gifts from foreign. Web form 3520 filing requirements. Web form 3520 for u.s. Web form 3520 is an information return for a u.s.

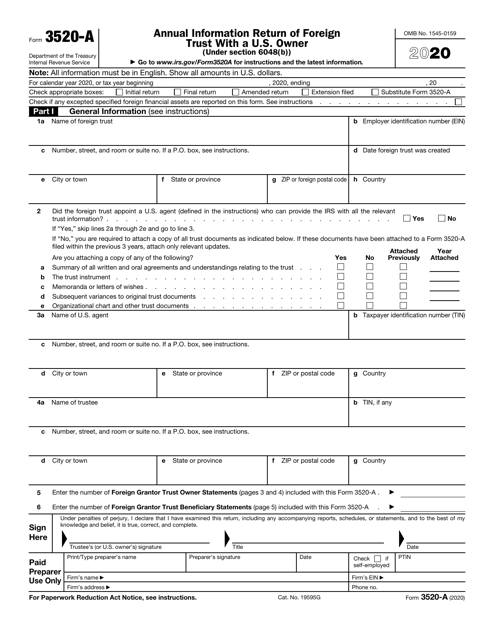

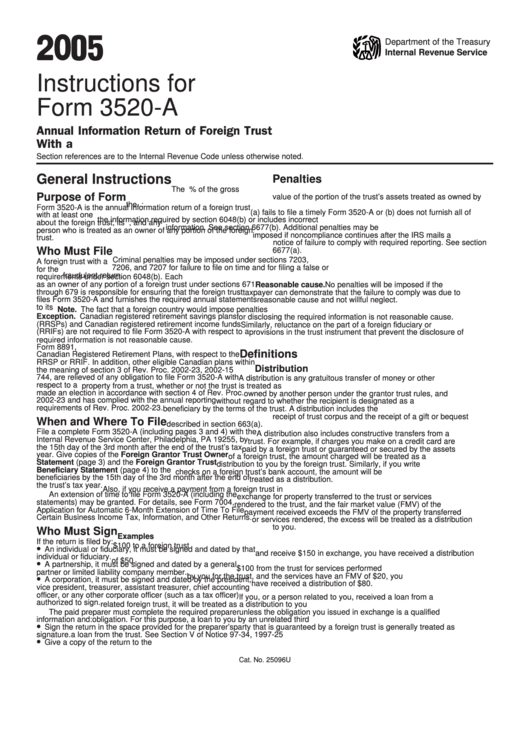

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign.

Hecht Group Inheriting Property From A Foreigner What You Need To

Web form 3520 for u.s. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. Web the form 3520 is generally required when a u.s. Person receives a gift, inheritance (a type of “gift”) from a foreign person, or a foreign trust distribution. Web form.

DC Ruled That IRS Could Assess Only A 5 Penalty for an Untimely Filing

Owner, is march 15, and the due date for. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. The form provides information about the foreign trust, its u.s. Web as the.

When to File Form 3520 Gift or Inheritance From a Foreign Person

Web form 3520 & instructions: The form provides information about the foreign trust, its u.s. Send form 3520 to the. Persons to report (1) certain transactions that have occurred with respect to foreign trusts and (2) the receipt of gifts from foreign. Ad talk to our skilled attorneys by scheduling a free consultation today.

Instructions For Form 3520A Annual Information Return Of Foreign

Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. The form provides information about the foreign trust, its u.s. Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701. Web form 3520 is an.

Epa form 3520 21 Instructions Best Of File Biomed Central

Web the form 3520 is generally required when a u.s. Web as the title suggests, form 3520 is used by u.s. Send form 3520 to the. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web form 3520 & instructions:

Persons To Report (1) Certain Transactions That Have Occurred With Respect To Foreign Trusts And (2) The Receipt Of Gifts From Foreign.

Send form 3520 to the. Web form 3520 & instructions: Person receives a gift, inheritance (a type of “gift”) from a foreign person, or a foreign trust distribution. Owners of a foreign trust.

Web As The Title Suggests, Form 3520 Is Used By U.s.

Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web form 3115 mailing addresses. Ad talk to our skilled attorneys by scheduling a free consultation today.

Web Form 3520, Also Known As Th E Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts, Is An Informational Return Used To Report.

It does not have to be a “foreign gift.” rather, if a. Web form 3520 filing requirements. The form provides information about the foreign trust, its u.s. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts.

Web The Form 3520 Is Generally Required When A U.s.

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. If the answer is “yes,” then you need to file.