Where To File Form 568

Where To File Form 568 - Web using black or blue ink, make the check or money order payable to the “franchise tax board.” write the llc’s california sos file number, fein, and “2020 form 568” on the. Web overview if your llc has one owner, you’re a single member limited liability company (smllc). Web to enter the information for form 568 in the 1040 taxact ® program: However, you cannot use form 568. Web file limited liability company return of income (form 568) by the original return due date. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Most llcs doing business in california must file form ca form 568 (limited liability company return of income), form ftb 3522 (llc tax. Web what is form 568? Web your llc in california will need to file form 568 each year. The llc is organized in.

Web using black or blue ink, make the check or money order payable to the “franchise tax board.” write the llc’s california sos file number, fein, and “2020 form 568” on the. The llc is doing business in california. Web along with form 3522, you will have to file ca form 568 if your llc tax status is either as a disregarded entity or a partnership. Line 1—total income from schedule iw. Thus, you will need to file both if you are running a. If you are married, you and your spouse are considered one owner and can. Most llcs doing business in california must file form ca form 568 (limited liability company return of income), form ftb 3522 (llc tax. The llc must file the appropriate. Web what is form 568? Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option.

The llc fee and franchise tax will be taken into consideration. Web • form 100s, california s corporation franchise or income tax return • form 100x, amended corporation franchise or income tax return • form 199, california exempt. Form 568 must be filed by every llc that is not taxable as a corporation if. Thus, you will need to file both if you are running a. Most llcs doing business in california must file form ca form 568 (limited liability company return of income), form ftb 3522 (llc tax. The llc is organized in. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Web file limited liability company return of income (form 568) by the original return due date. Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. You and your clients should be aware that a disregarded smllc is required to:

I am filing my business as sole proprietor. But for California s

Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Web overview if your llc has one owner, you’re a single member limited liability company (smllc). Web to add limited liability, form 568 to the california return, choose file > client properties > california tab and mark the.

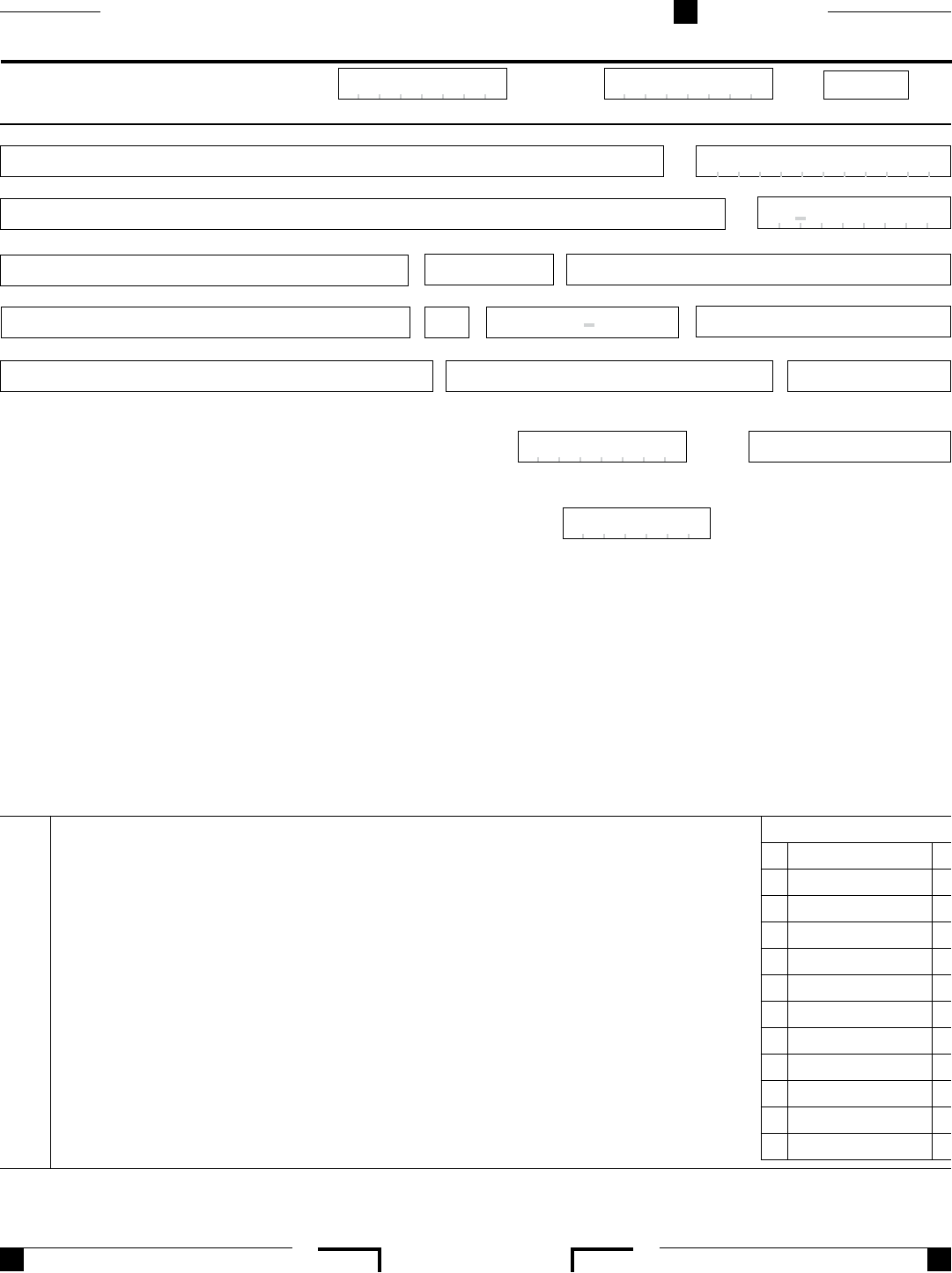

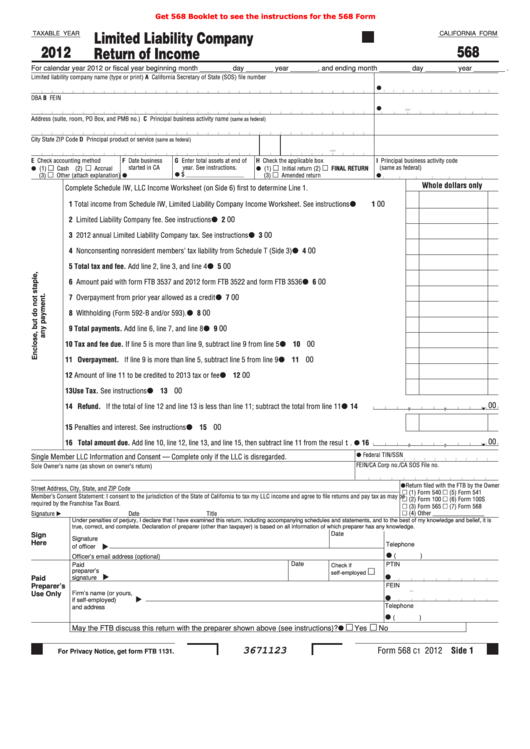

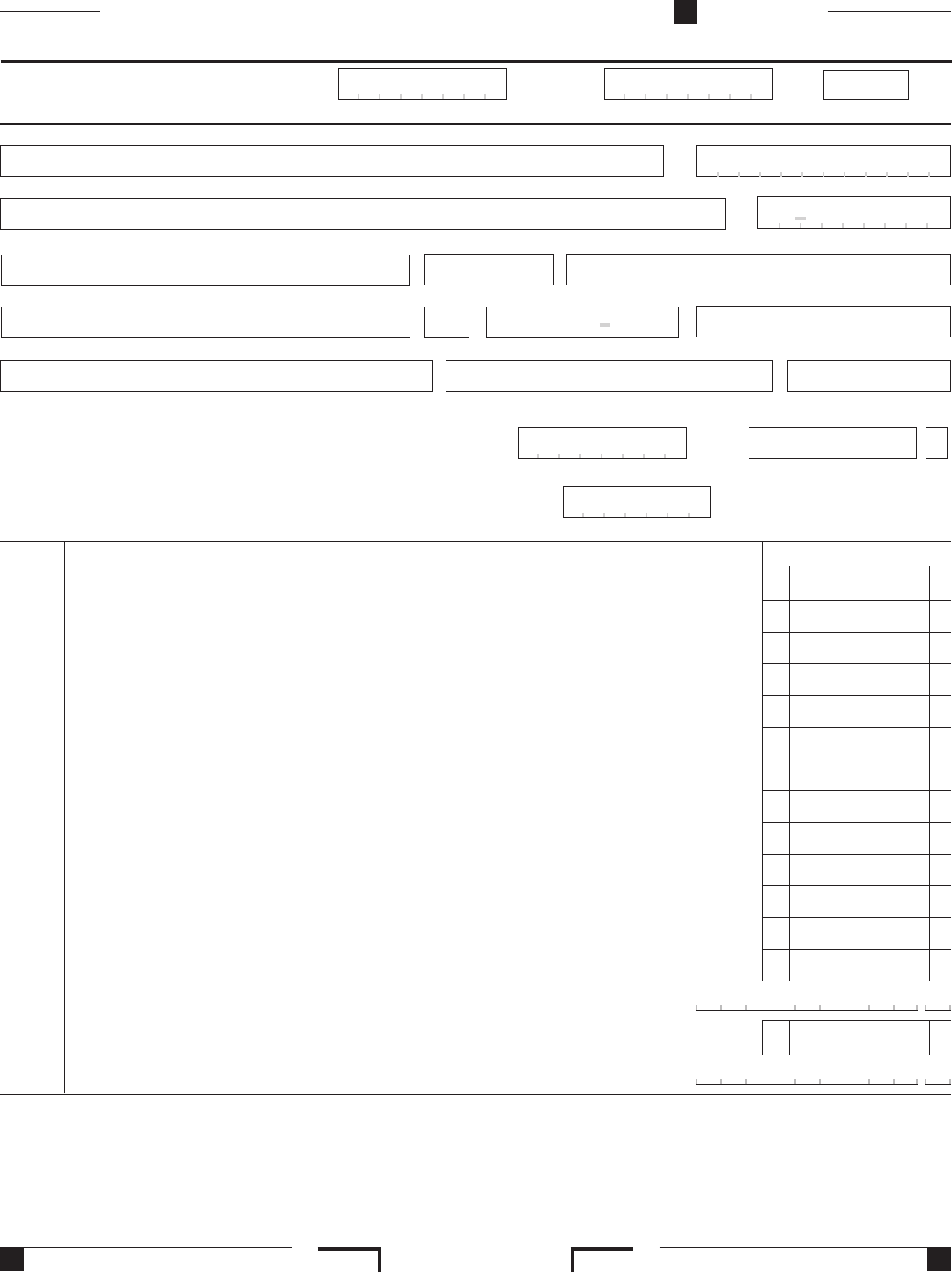

2002 Form CA FTB 568BK Fill Online, Printable, Fillable, Blank pdfFiller

The llc fee and franchise tax will be taken into consideration. If you are married, you and your spouse are considered one owner and can. The llc must file the appropriate. Web to enter the information for form 568 in the 1040 taxact ® program: Web using black or blue ink, make the check or money order payable to the.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Web support state and local tax information california how do i file ca form 568 for a partnership? Web california form 568 for limited liability company return of income is a separate state formset. Web using black or blue ink, make the check or money order payable to the “franchise tax board.” write the llc’s california sos file number, fein,.

Fillable California Form 568 Limited Liability Company Return Of

Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Line 1—total income from schedule iw. Web to add limited liability, form 568 to the california return, choose file > client properties > california tab and mark the form 568 limited liability company checkbox in the other. Form 568 must be filed by.

Ca Form 568 Instructions 2021 Mailing Address To File manyways.top 2021

Web to add limited liability, form 568 to the california return, choose file > client properties > california tab and mark the form 568 limited liability company checkbox in the other. If you are married, you and your spouse are considered one owner and can. However, you cannot use form 568. Web form 568 must be filed by every llc.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

From within your taxact return ( online or desktop), click state to expand, then click california (or ca ). Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: If you are married, you and your spouse are considered one owner and can. Web file limited liability company.

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

If you are married, you and your spouse are considered one owner and can. It isn't included with the regular ca state partnership formset. Web to add limited liability, form 568 to the california return, choose file > client properties > california tab and mark the form 568 limited liability company checkbox in the other. Web form 568 must be.

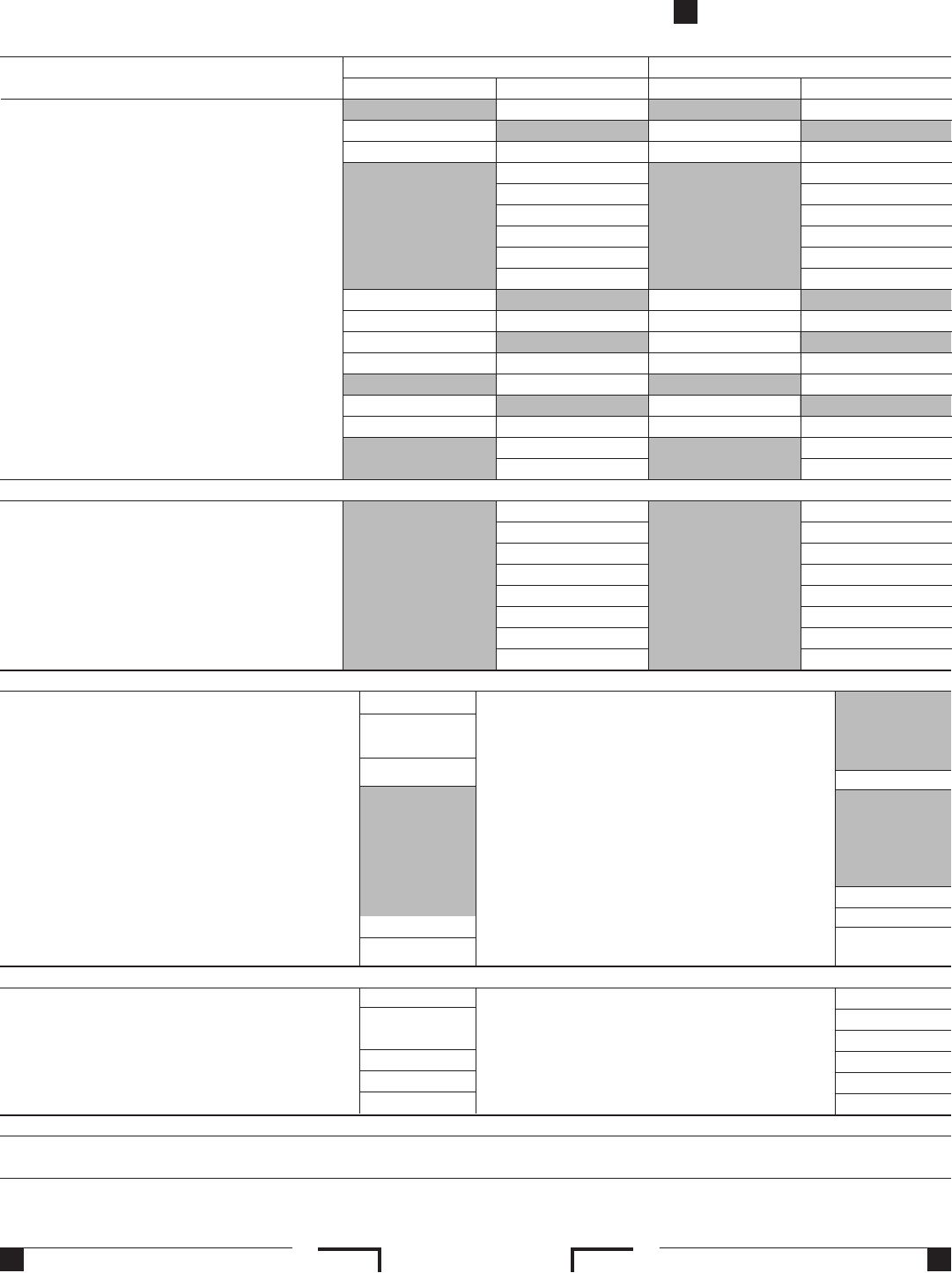

California Schedule K 1 568 Form Fill Out and Sign Printable PDF

The llc is doing business in california. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. However, you cannot use form 568. Thus, you will need to file both if you are running a. The llc fee and franchise tax will be taken into consideration.

Solved Does Turbo tax Business efile CA FORM 568 for single member LLC

Web support state and local tax information california how do i file ca form 568 for a partnership? Web overview if your llc has one owner, you’re a single member limited liability company (smllc). Web what is form 568? Web to enter the information for form 568 in the 1040 taxact ® program: However, you cannot use form 568.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

Web • form 100s, california s corporation franchise or income tax return • form 100x, amended corporation franchise or income tax return • form 199, california exempt. The llc is organized in. Web your llc in california will need to file form 568 each year. Web since the limited liability company is doing business in both nevada and california, it.

Llcs May Be Classified For Tax Purposes As A Partnership, A Corporation, Or A Disregarded Entity.

Form 568 must be filed by every llc that is not taxable as a corporation if. If your llc files on an extension, refer to payment for automatic extension for llcs. Most llcs doing business in california must file form ca form 568 (limited liability company return of income), form ftb 3522 (llc tax. From within your taxact return ( online or desktop), click state to expand, then click california (or ca ).

Web Form 568 Must Be Filed By Every Llc That Is Not Taxable As A Corporation If Any Of The Following Apply:

Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Web to enter the information for form 568 in the 1040 taxact ® program: Web support state and local tax information california how do i file ca form 568 for a partnership? You and your clients should be aware that a disregarded smllc is required to:

Web • Form 100S, California S Corporation Franchise Or Income Tax Return • Form 100X, Amended Corporation Franchise Or Income Tax Return • Form 199, California Exempt.

Web if you have an llc, here’s how to fill in the california form 568: Web file limited liability company return of income (form 568) by the original return due date. Web along with form 3522, you will have to file ca form 568 if your llc tax status is either as a disregarded entity or a partnership. However, you cannot use form 568.

Web Llcs Classified As Partnerships File Form 568.

Web using black or blue ink, make the check or money order payable to the “franchise tax board.” write the llc’s california sos file number, fein, and “2020 form 568” on the. The llc is organized in. The llc fee and franchise tax will be taken into consideration. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use.