Tn Form Fae 170 Instructions 2021

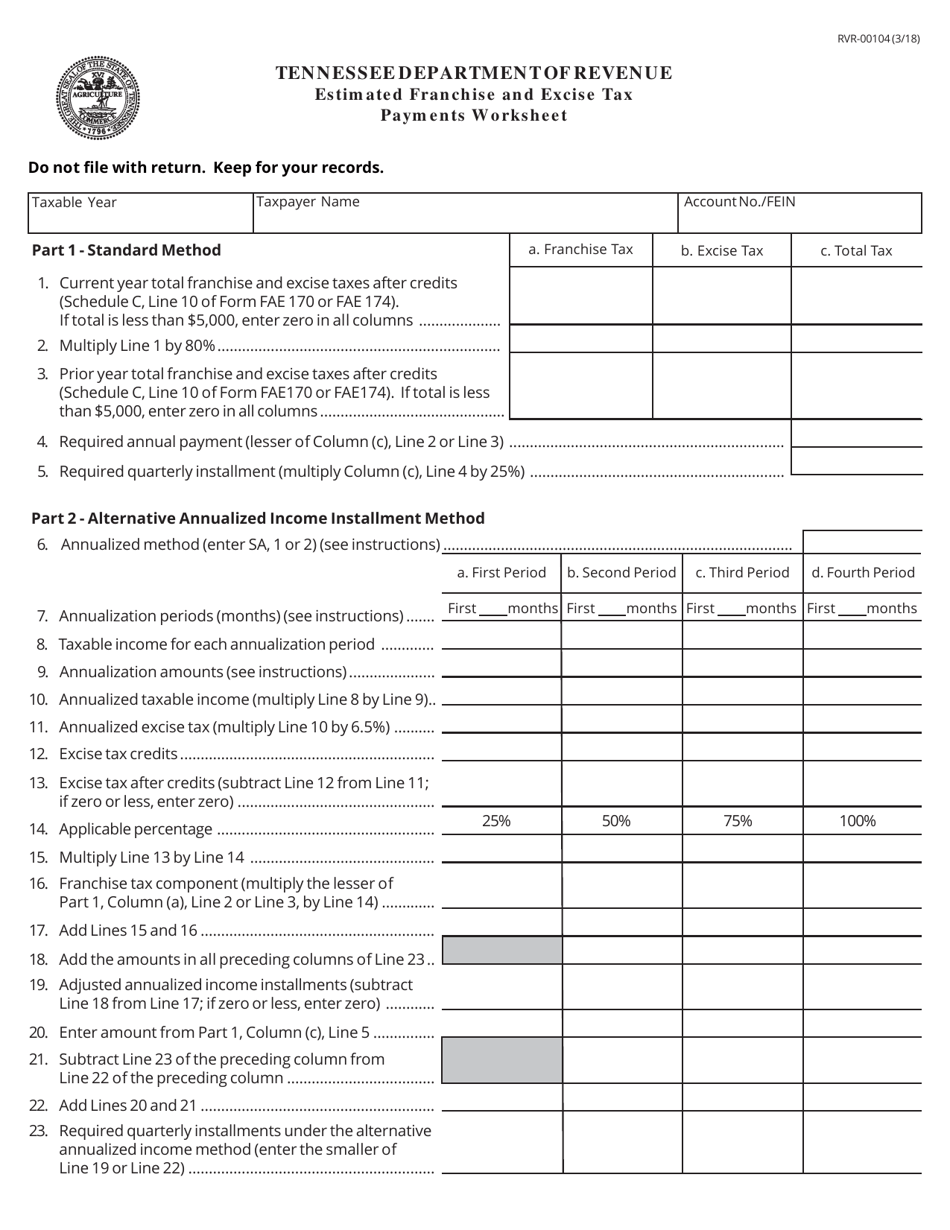

Tn Form Fae 170 Instructions 2021 - Web send tn form fae 170 via email, link, or fax. Web these taxes are reported and paid with form fae 170, due on april 15th each year, for the preceding year. Web the due date of this return is the 15th day of the 4th month following the period end date as shown on the corresponding federal income tax return filed, even if that return was filed. Web fae 170 tennessee department of revenue franchise and excise tax return tax year beginning tax year ending amended return mailing address city legal name. Web file a franchise and excise tax return (form fae170). Web form fae170 returns, schedules and instructions for prior years. Enjoy smart fillable fields and interactivity. Web follow the instructions below to complete tennessee tax form fae 170 online quickly and easily: Sign up with your credentials or create a free account to. Sign online button or tick the preview image of the form.

Use this screen to enter information for form fae 170, franchise excise tax return. Get your online template and fill it in using progressive features. Log in to your account. Web industry 2021 general information electronic filing and payment is required unless you have received a hardship exemption. Web form fae170 returns, schedules and instructions for prior years. Partnership approved 12/2 8/202 1. Web tennessee state facts sheet state packages electronic filing 1040, 1120, 1120s, & 1065. Sign online button or tick the preview image of the form. Sign up with your credentials or create a free account to. Web these taxes are reported and paid with form fae 170, due on april 15th each year, for the preceding year.

Web tennessee state facts sheet state packages electronic filing 1040, 1120, 1120s, & 1065. Web the way to fill out the tn form 170 instructions on the internet: Web tennessee franchise, excise fae 170 tax return. See the fae 170 instructions for information on how. If the partnership is inactive in tennessee, enter an x on the tennessee > general > basic data > taxpayer is. File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax. Web fae 170 tennessee department of revenue franchise and excise tax return tax year beginning tax year ending amended return mailing address city legal name. Sign up with your credentials or create a free account to. Web thinking of filing tennessee form fae 170? For tax years beginning on or after 1/1/21, and ending on or before 12/31/21.

20132021 Form TN LB0441 Fill Online, Printable, Fillable, Blank

Web thinking of filing tennessee form fae 170? Sign up with your credentials or create a free account to. Web industry 2021 general information electronic filing and payment is required unless you have received a hardship exemption. Web these taxes are reported and paid with form fae 170, due on april 15th each year, for the preceding year. Public chapter.

2010 Form TN DoR FAE 170 Fill Online, Printable, Fillable, Blank

The easiest way to modify how to franchise excise tax return tennessee in pdf format. If the partnership is inactive in tennessee, enter an x on the tennessee > general > basic data > taxpayer is. Enjoy smart fillable fields and interactivity. File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax..

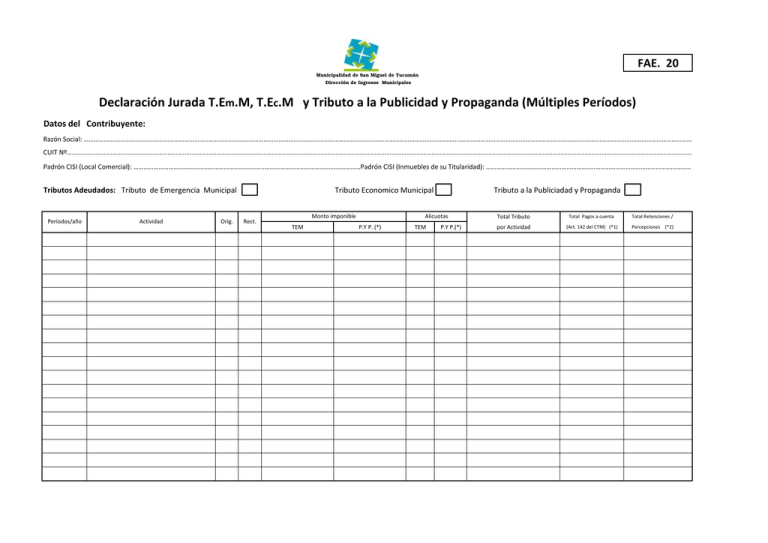

FORM. FAE.20.xlsx

Web tennessee state facts sheet state packages electronic filing 1040, 1120, 1120s, & 1065. Web send tn form fae 170 via email, link, or fax. Log in to your account. Web thinking of filing tennessee form fae 170? File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax.

20172020 Form TN DoR FAE 170 Fill Online, Printable, Fillable, Blank

See the fae 170 instructions for information on how. You can also download it, export it or print it out. Partnership approved 12/2 8/202 1. Generally, hardship exceptions will include taxpayers. For detailed information on creating llc activities, click the processing 1040.

tn franchise and excise tax mailing address Blimp Microblog Custom

S corporation approved 12/2 8/202 1. Web the due date of this return is the 15th day of the 4th month following the period end date as shown on the corresponding federal income tax return filed, even if that return was filed. File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax..

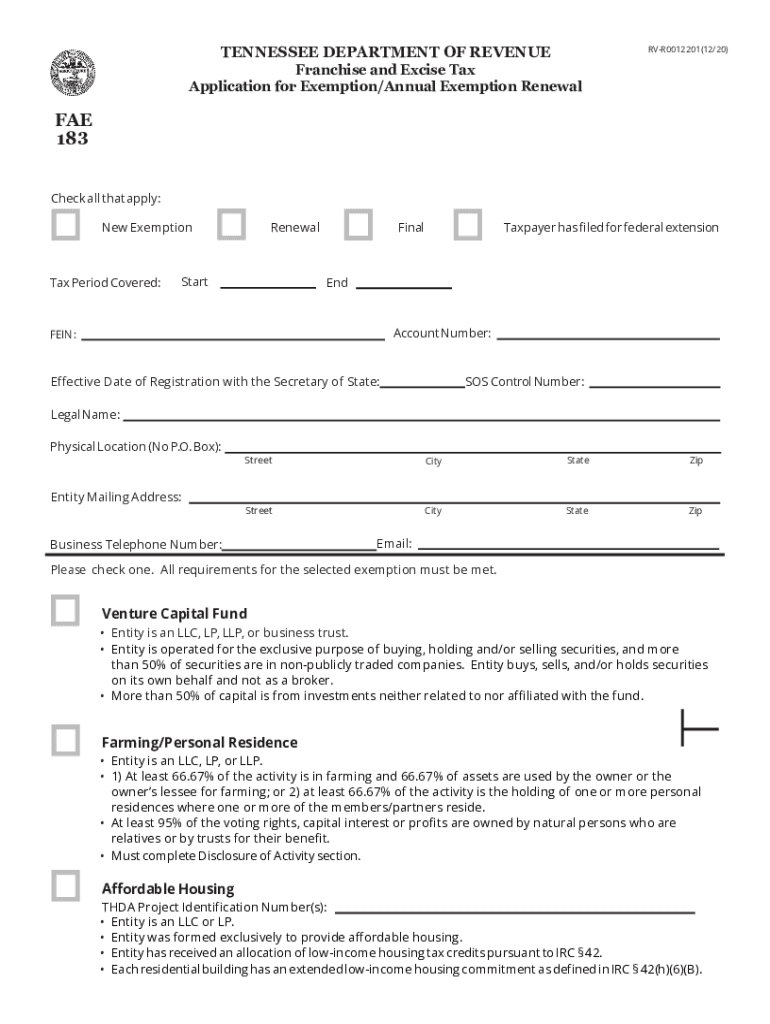

Tn Fae 183 Fill Online, Printable, Fillable, Blank pdfFiller

Web tennessee state facts sheet state packages electronic filing 1040, 1120, 1120s, & 1065. Web how to fill out and sign tn form fae 170 instructions 2021 online? Web fae 170 tennessee department of revenue franchise and excise tax return tax year beginning tax year ending amended return mailing address city legal name. Web file a franchise and excise tax.

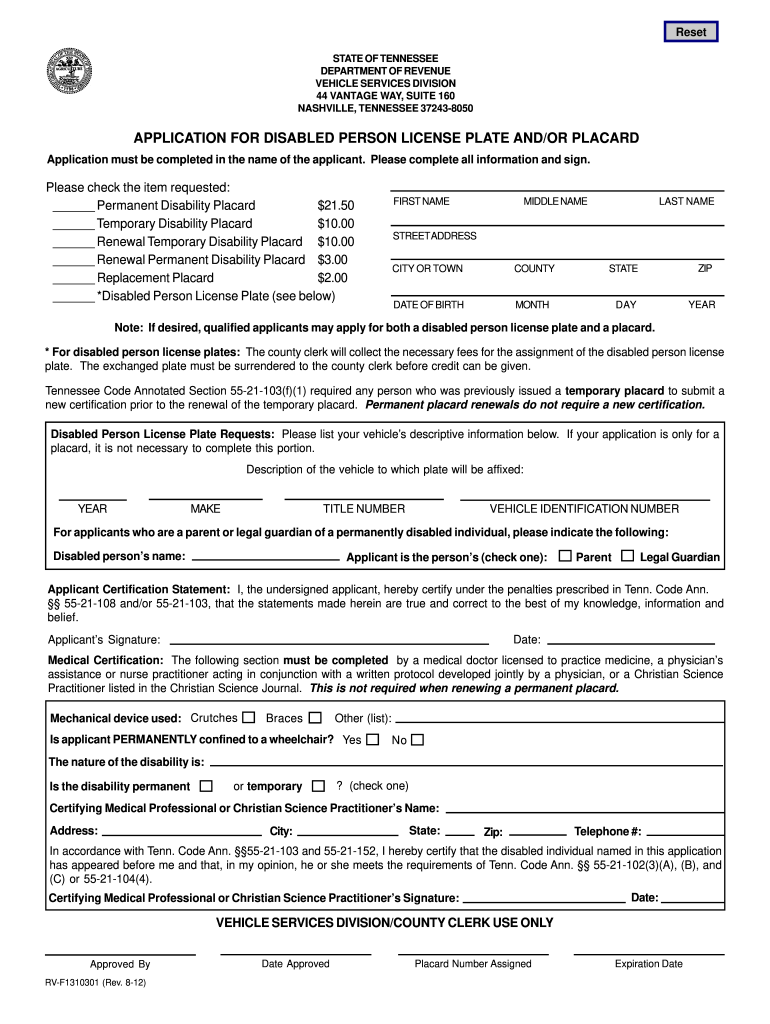

Form Rv F1310301 Fill Out and Sign Printable PDF Template signNow

Web thinking of filing tennessee form fae 170? Web tennessee state facts sheet state packages electronic filing 1040, 1120, 1120s, & 1065. You can also download it, export it or print it out. Partnership approved 12/2 8/202 1. Get your online template and fill it in using progressive features.

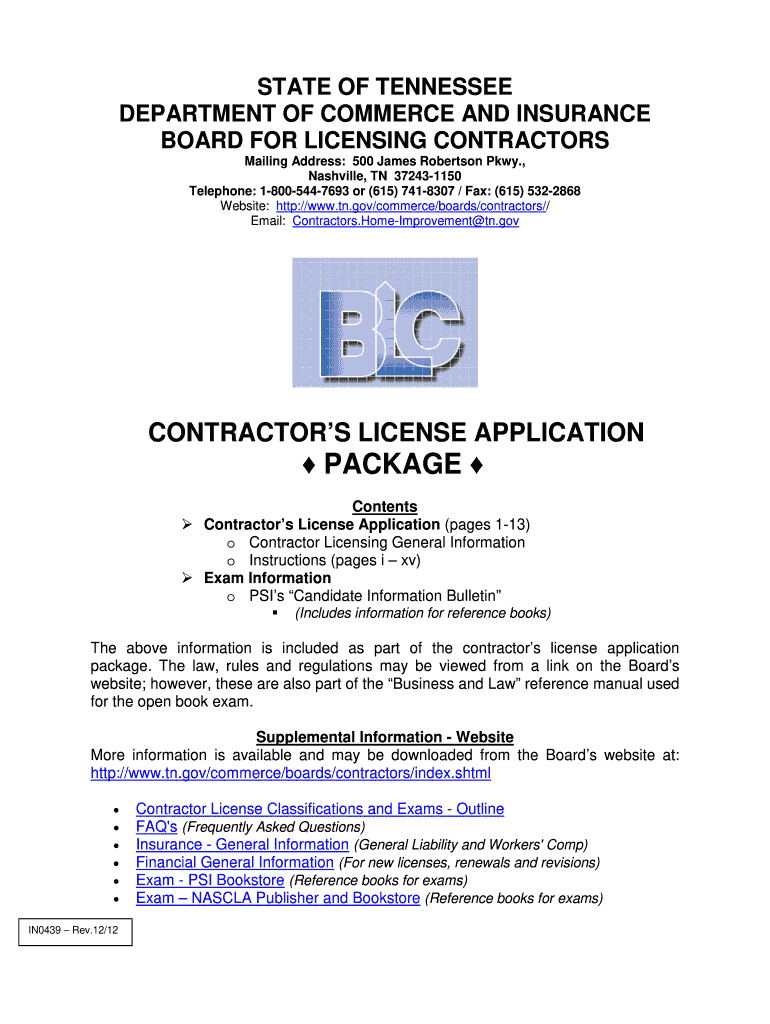

Home Improvement License Tn Form Fill Out and Sign Printable PDF

Fae 183 return types not accepted: File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax. Sign online button or tick the preview image of the form. Web follow the instructions below to complete tennessee tax form fae 170 online quickly and easily: Web file a franchise and excise tax return (form.

tn franchise and excise tax guide Ashly Fajardo

You can also download it, export it or print it out. Web industry 2021 general information electronic filing and payment is required unless you have received a hardship exemption. Enjoy smart fillable fields and interactivity. Public chapter 559 (2021) changes the f&e filing extension period from six months to seven. Web tennessee franchise, excise fae 170 tax return.

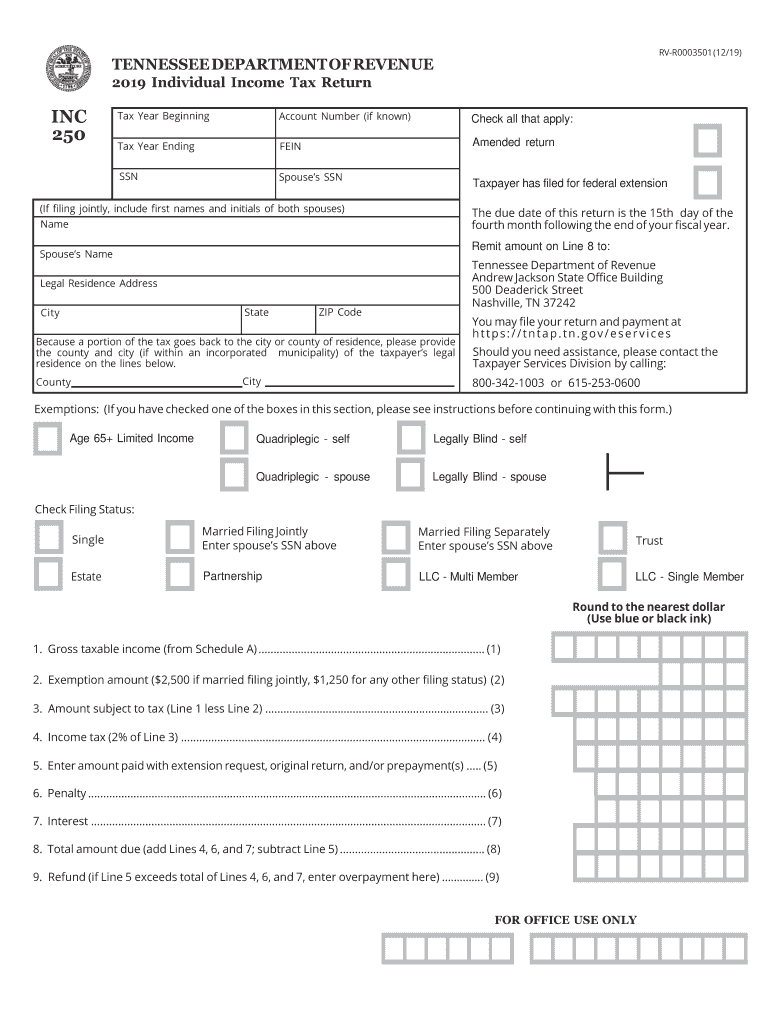

2019 Form TN DoR INC 250 Fill Online, Printable, Fillable, Blank

Web thinking of filing tennessee form fae 170? Partnership approved 12/2 8/202 1. File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax. For tax years beginning on or after 1/1/21, and ending on or before 12/31/21. Web tennessee state facts sheet state packages electronic filing 1040, 1120, 1120s, & 1065.

Fae 183 Return Types Not Accepted:

You can also download it, export it or print it out. Sign online button or tick the preview image of the form. Web thinking of filing tennessee form fae 170? For tax years beginning on or after 1/1/21, and ending on or before 12/31/21.

Use This Screen To Enter Information For Form Fae 170, Franchise Excise Tax Return.

Web fae 170 tennessee department of revenue franchise and excise tax return tax year beginning tax year ending amended return mailing address city legal name. Enjoy smart fillable fields and interactivity. S corporation approved 12/2 8/202 1. See the fae 170 instructions for information on how.

Web The Due Date Of This Return Is The 15Th Day Of The 4Th Month Following The Period End Date As Shown On The Corresponding Federal Income Tax Return Filed, Even If That Return Was Filed.

Web industry 2021 general information electronic filing and payment is required unless you have received a hardship exemption. If the partnership is inactive in tennessee, enter an x on the tennessee > general > basic data > taxpayer is. Generally, hardship exceptions will include taxpayers. Web file a franchise and excise tax return (form fae170).

Web Tennessee Franchise, Excise Fae 170 Tax Return.

Web these taxes are reported and paid with form fae 170, due on april 15th each year, for the preceding year. Sign up with your credentials or create a free account to. Log in to your account. Web tennessee state facts sheet state packages electronic filing 1040, 1120, 1120s, & 1065.